The new strategy breathes life into the market, so we’re offering an ‘elite wave theory’ familiar as Relief Elite. With nothing special to fill his day with, Elliott turned concentration to the behavior of the stock market and developed his assumption in the last stages of his life. Born an accountant, he retired at 58 from a tour to South America after getting affected by the virus. This is an older trading policy, first published in 1938 as a book called The Wave Principle. Until then, the general perception was that the market performed chaotically and that there were not several trading plans.

Mr. Elliott examined stock price data for almost 70 years of his life. He indicated that the market is run by human psychology; they are not behaving chaotically. Instead, the data explained that the market moves with repetition. Then Elliott developed his assumption based on crowd psychology.

It can be difficult to live in exactly the same state of mind or mood, except for those who, of course, have a pathological disorder. So, he concluded that group psychology at various levels shifts from optimism to distrust and back to optimism. He applied this hypothesis to the financial market, which strongly recommended that for the duration of strong trends when the ‘mood’ in the market changes, it comes intermittent intervals. At this point, participants of the market sell the financial tools they have obtained and reinvest in them at a low price when the mood is optimistic again. The conflicting situation applies to a powerful downtrend.

Ralph Elliott

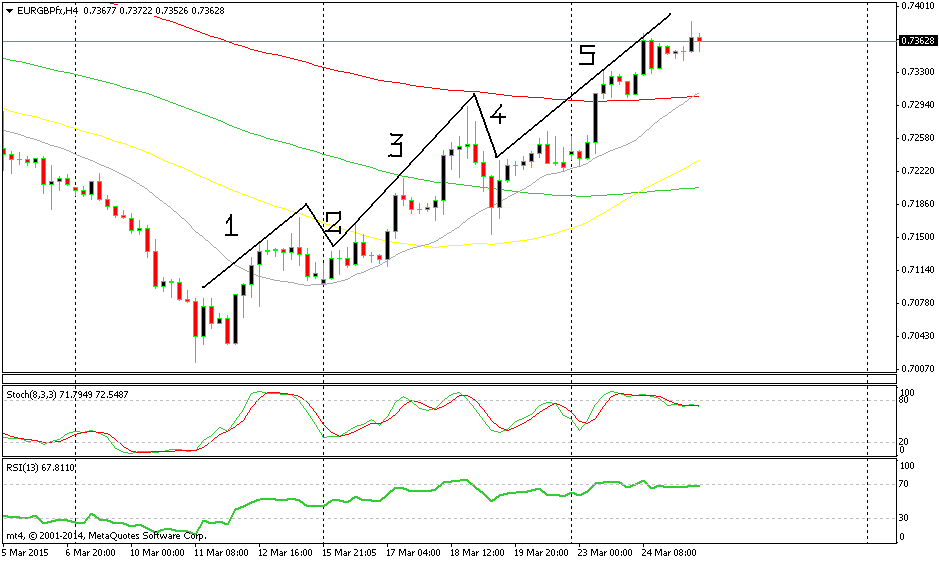

Let us now begin to explain the Elliott Wave Theory (EWS). As stated above, mob psychology dictates that the market will “swing” between hope and despair. Because the financial market is primarily a large group of human shareholders, the crowd attitude naturally applies. In a bullish market, when shareholders are in a constructive mood, they are more eager to adopt dangers and buy stocks, bonds, a few currencies, commodities, etc. the importing spree, which increases the prices, is famous as the satisfactory or motion phase. Once the buyer’s remorse is determined, a logical amount of these financial tools is thrown back into the market. Down prices Selling is named as the corrective phase, and thus, the chart is corrected, according to bullish markets. According to EWS, the stimulus phase occurs in 5 stages (see chart below).

In the chart above, the first wave demonstrates that buyers are ready to take more risks, which is usually in a bullish market, sending the costs up. The 2nd wave (1) reflects the element of human feeling, as fear lowers the price by making a corrective move on the chart. Analysts and dealers frequently refer to this as an emotional wave, as in a bullish market, you are probably to buy. After all the emotions and fears have subsided, shareholders feel bullish once more and buy, which has the status of a strong increase in the chart (3). After that comes the fourth wave (4), which is the 2nd correction wave, and it works to ‘push back’ the wave. After the 5th wave, (5) finally at the expected height for the bullish market, the price approaches the highest point of this pattern.

Must Read: How Brexit and Grexit affect the Forex Market

But the Elliott Wave Trading is not over so for. These five steps are the initial part of the policy, and usually, the price rises steadily from the base of the first wave to the peak of the very last wave. Now, if you extend this chart for a long time, it will sound like only one uptrend. In general, we should see an improvement, which will appear as a second wave in the long run. However, when we return to the short term, we can see that this happens many times. Elliott Wave Theory describes it as a major corrective trend and consists of three waves: A, B, and C (pictured below).

Correspondingly the above Elite Wave Theory depiction is part of a bigger, longer structure; other minor outlines may also be involved. Every impulsive wave of this outline (1) consists of 5 small, intermittent outlines. These minor corrective waves are concluded of small A, B, C corrective trend of the smaller ones. Outlines of short Elite Wave are created by the psychological cycles of dealers and investors who use short time frame charts.

This policy is ordinary, and a lot of dealers use it as their main indicator of market forecasting. So with some detail, our readers can include in this policy into their personal market routines. We gave details of the basics of Elliott Wave theory. More articles will make clear how to further improve your purchasing policy.