Grexit

Last year, Greek Prime Minister Alexis Tsipras called his people to a referendum on whether Greece should remain in the European Union (EU). The European Union (EU) has lent billions of euros to Greece to pay off its financial crisis.

In 2012, Greece get a financial aid, where half of its debt was written off by European banks and administration, and hitherto Greece has preserved its comfortable working position paralleled to northern European countries – and tax revenues are not in line with government spending. Therefore, for the EU, it was tantamount to throwing money into a black hole, and because of that, the EU forced new steps for Greece, and the Greek Prime Minister sent it to the people’s election.

In fact, the referendum itself was about whether Greece would agree for economic processes as raising taxes and the retirement age. The European Union forced it on Greece to send cash in the next round. If the Greeks selected against the steps, it would mean that Greece would be excluded from the European Union. It looked tough, but there was no other option. On July 5, 2015, the Greeks elected in favor of staying in the EU and accepting new limitations from the EU. Currently, Greece is a small nation, and its economy is just 1% of the European Union. Therefore the Euro actually doesn’t mind the Greek vote.

Brexit

The Brexit position is another problem. The UK is an established member and one of the four largest economies within the European Union. If the British people leave the EU, it could trigger a “domino effect” for other members of the EU. The anti-euro forces are gaining strength in European countries, especially after the massive wave of immigration that began in 2012-13 after the “Arab Spring” is going in power now.

In Germany, the Netherlands, Hungary, etc., far-right parties are receiving more votes than voters, and in France, the National Front won the last local elections. An expected Brexit would further encourage these manipulative countries and give them a solid motive to express their reasons to their people. But, Referendum Day following month, the survey display that the rest of the campaign was a little fast of last month. Sensibly, it looks good, but usually, Joe didn’t share his view. I spoke to a lot of British citizens before the referendum, and it was amazing how most of them, especially those over 40, were supporting Brexit.

The referendum had been circling the whole month of June, and the chances of the other party winning the referendum were always greater than those of the bookies. In the last few days, the referendum conveys that this side has benefited a little. The assassination of Labor member Jo Cox, a pro-EU election worker a few days before the referendum by an EU extremist / disturbed spirit, may have added some facts to the rest. However, during the BBC argument, the strong left-wing chairs showed that they too could win.

In the last two weeks before the Brexit referendum, the foreign exchange market was highly unstable, especially to the GBP pair and the Euro pair to a lesser degree. The pricing process was disordered, with no clear direction, and the actions were fairly large. You can simply be whipsawed, so we decided to keep the FXML here, as well as a maximum of the market members, especially the GBP pairs obvious to remain clear.

The day of the Brexit referendum finally reached on June 23, but there is no leaving referendum in the UK, so we called it one afternoon. When I woke up the day after the referendum, I turned on the computer to see the Forex chart. At that moment, I saw the GBP down about 20 cents and the Euro about 5 cents. I feel the game was finish. Voters over the age of 45-50 were the only ones who chose voting booths in the draw, and the same age group supported Brexit. Although people under the age of 40-45 highly opposed Brexit, their turnout was lower on Election Day. New Prime Minister of Britain, Theresa May, who is running an anti-Brexit campaign, selected Boris Johnson as her foreign secretary and is pushing for a press the ‘Article 50’ button to activate the actual exit.

The Pound before the Referendum

The Brexit referendum was declared many years ago, but the pound did not feel the force until it was adequately nearer to really feel the effects. When that occurred in late 2015, it dropped by about 20 cents by February 2016. The move comes amid fears that Brexit will happen, and that London will lose its part as a global financial center. Several people opine that New York is the global financial center, but half of the FX merchandized in London, which translates to about $ 2.5 trillion in daily trade.

However, it was the reason, and we found some indications of long-term foreign exchange during this very downward movement. Then the referendum began, and everything was a disorder. In such a case, it would be better to stay, because we did not know what the upcoming referendum would be like. Due to this, we started the referendum in recent weeks by lowering our foreign exchange signals in the GBP pair and only opened short-term forex signals in the short term.

The Pound After the Referendum

Like most people, we thought the UK would vote to stay in the EU, which will set a good effect on the GBP.

Short-term

The short-term response was very short. It was above the fast and remained just for few hours. The average trader already knew what was happening. The British pound down to 18 cents in a matter of hours, providing some huge gains along the down way. It lowered the exchange rate between GBP and other major currencies by 20 cents for the coming months/years. The deflation of the GBP has reduced the size of the UK economy, and currently, the UK is the sixth-largest economy in the globe, with France ranked fifth.

Medium-term

In the medium term, there will be uncertainty. The bottom line, of course, is the weakest, as we feel in the first and second weeks after the Brexit referendum. The 1.30 level was broken again, and the GBP / USD fell below 1.28. But, the market is useless; no one is sure what is going to happen politically or how the British economy will respond. We already had some indicators for July that significant forecast sectors in the UK economy. It is clear that the way in which Brexit will emerge politically and economically is not clear, leaving the GBP pair without a clear line. Of course, the negative risk is greater, but be careful whichever side you like to move because the pass will be too large.

Long Term

The Scottish selected overwhelmingly to remain in the UK, and we don’t know how the Scots would respond. Some flaws may depend on time, as the financial industry in London. It is the largest sector of the UK economy and generates the most revenue, but the industry could move from the EU to Frankfurt with the UK or go over Europe. The French prime minister was struggling to persuade financial companies to go to France. It looks like everyone will prefer a piece of action from the UK’s major financial sector.

The Euro after the referendum

Many people opine that the Euro would not be affected by Brexit. However, the UK alone was exiting the EU, which has about 450 million members. The UK has a population of only 65 million. Yet, it has other inferences, as the increase of nationalist parties in other European countries that have now provided legitimacy to their reason. This could lead to a domino result in the EU.

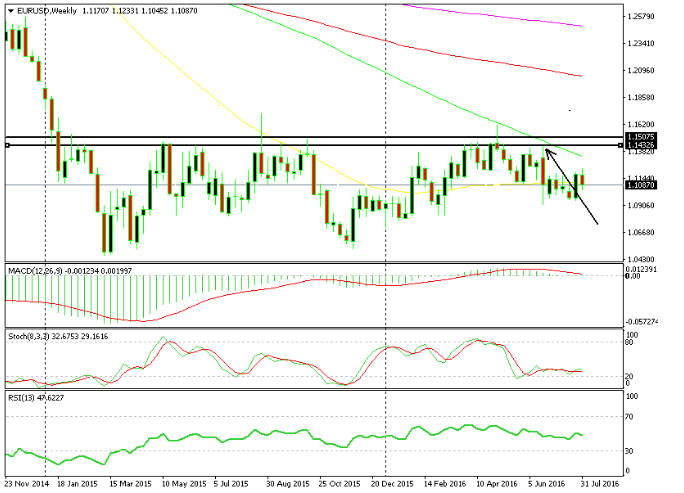

So it makes Europe as well as Britain very weak. The Euro first warmed up and fell by about 500 pips the day after the Brexit poll. Still, the EUR / USD could not break 1.09 and the pair make a base in the range of 1.0900-1.0950 for more than a month. If there is a massive decrease of the Euro, it will probably happen from the economic condition in the European Union and the moves of the ECB. Unlike the UK economy, the EU economy is not affected by Brexit, so it has affected and will continue to affect the particular currencies in the future months/years.

Brexit impact on the EU and financial markets

The Brexit poll clearly had a negative effect on the UK stock exchange FTSE as well as other stock markets around the globe. On Friday alone, the FTSE 250 fall about 15% of its worth, whereas other catalogs like DAX, Nikkei, and NYSE fall between 5 and 10. Yet, the losses have since been improved.

France’s national front leader, a Eurosceptic and right-wing extremist, has warned of a referendum on Brexit. Hungary’s leadership has long had open fights with the European Union and close ties to the Kremlin. Anti-EU voices are being raised by other EU member states such as Austria, the Netherlands, Finland, etc. The EU’s open-door immigration strategy and economic disaster are putting a heavy burden on the European citizens, as far as it goes and unrealistic, the closure of the EU is a likely situation. Finally, Brexit didn’t expect real till it actually occurs.

Our Performance

As we mentioned in the Brexit section above, we were not interested in trading with the relative pairs (CHF, Euro, and GBP pairs) specifically during the Brexit poll procedure. The referendum resulted in significant fluctuations in the GBP pair over the months, and especially last month. All these referendums removed the difficulty of winning from one side to the other. Therefore, we decided to stay away.

Before the referendum day, just the last day before the results, we saw a good trade chance. The EUR / USD was near to 1.14, which is the bottom line of the 1.14-1.15 confrontation bunch. We have decided to open a long term Forex signal in the Forex pair due to this:

- This was a durable conflict area, and the ECB does not feel relaxed all time there is a price, so ECB members were hoped to slap the Euro at any time with their remarks.

- Extensive votes were expected in most markets, so if the Brexit party lost, everything was priced because it would not be a wonder. Any reversal would be a short-term increase, and the price would finally go down.

- If the Brexit side wins, it will be a good wonder, and the shock response will send the Euro down.

- The price was under the moving average of 100 on the regular chart to give good conflict before.

The Loser, the Brexit party, won, and it obviously appeared as a surprise. When I turned on the PC in the morning, GBP pairs were almost 20 cents down, and Euro pairs were almost 600 pips down. Therefore, we got the bad and good news from the Forex chart. The bad news is that the UK elected to exist in the EU, and the good news is that we got close to 300 pips from our EUR / USD long-term forex signal, which in fact took less than 24 hours to close.

On the same day, we were taking a closer look at the GBP / USD forex chart. The result of the poll was obvious, as well as its negative result on the GBP also. Consequently, after a 20% reduction, we looked forward to retreating. Seven hundred pips were recovered, and we decided to open the cell forex signal close to the level of 1.39. We were firstly aiming 200 pip create revenue levels, but that day was quite expressive for all forex brokers, and we closed it manually for around 100 pips.

So, it was Brexit and all that happened with it. Though the ups and downs and were at height, we handle to overcome ourselves and take full advantage of these difficulties. Brexit is far away; we don’t know how profound and fast it will be, we don’t know what will happen to Britain. The Scots, conversely, selected to stay, and their response after the Brexit vote is not clear.