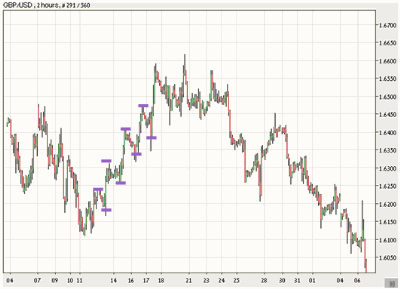

A single currency pair at a varied time frame directs the multiple time frames trading strategy to perform. From this chart, it is clear the high and lows, the perpetual and temporary market inclination. Other time frames are also showing the variations and structures that cannot be advertised with the help of a single time frame.

The above chart contains 360 candleholders forming one complete month.

There are mini trends shown on the left side of the chart in purple color. They will help us to see the shorter time frame.

This chart is showing a half-year time structure. All candle holders are showing each day. Keep it in mind that no one can learn about the complete section, just seeing a one-time frame. It is necessary to see the whole section before a deal. Analyzing the cost variation over different time frames can perform to point out, entering and exiting time into a market. Bitcoin in Philippines

Standard time frames

In such time frames, each candleholder shows 15-30 minutes or 1 hour. They are the central time frame to permit the investor enough time that he can easily analyze the market trend before he enters but is long-lasting to create high revenues within a short time frame.

Conclusion

As a result, all time frames are important in their areas. Long time frame supports to know the highest visible and recognize the complete market inclination. The average time frame shows a temporary market inclination and informs us about the existing market situations. Short time frames help to identify the real windows as the exact time to make an entry.

To implement several time frames examination, a trader should select a time frame to perform and then confirm his entry along with a longer time frame. While performing with three-time frames can also be irritating for a trader, but it is not impossible.