Pullback

The price action against the tendency is known as a pullback. The pullback is a temporary price action before it returns to the market. It is also frequently known as cost improvements or recoveries. Pullback occurs when the cost action is at least once the opposite side of the trend, then pullback happens.

- Expect the competition to look up or down to find the price in the beginner.

- When the pullback is slow, on the contrary, the trader will despair while the confidence of the fast traders will be regained.

- If it comes down powerfully and gives a strong signal of reassurance, the bar will become more violent, and the bulls will begin in the uncertainty of his status.

Advantages

- Trading pullbacks allow you to have strong stop-losses because your trading space is worthy, and you have a reasonable risk of recompenses.

- Psychologically to pull the trigger when you are purchasing at a peak cost and trade at a lower price is easy.

Features

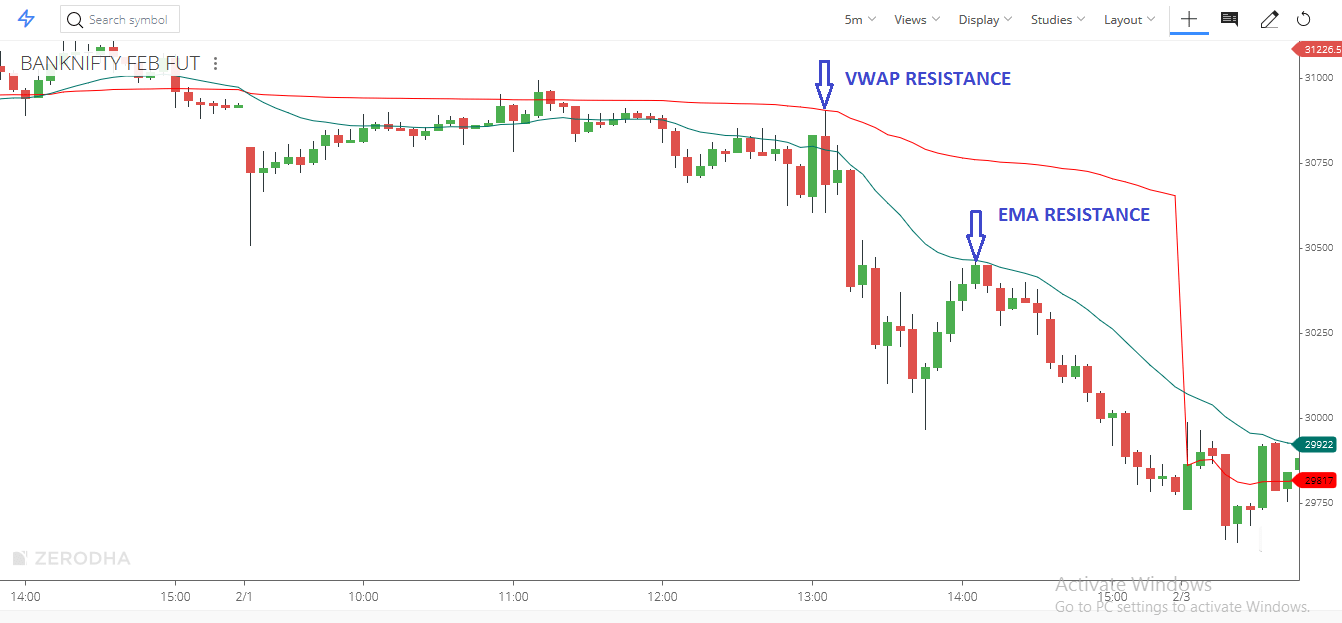

WEAK PULLBACK

- Small and weak momentum candle holder authentication

- Low volume improvement

- Light volume red and green candle’s mix

- Closes to the middle with the edges

- How the pullback occurs

STRONG PULLBACK

- First is a series of consecutive bearish bars(LH/LL)

- Second is the presence of strong bearish bar( trend bar)

- The third VOLUME DOES NOT REDUCE on a pullback

- Fourth Depth of pullback (deep)

- Fifth How pullback came (after consolidation)

- When pullback fails to bounce back quickly

Hence, a weak pullback is one that lacks all these features.

- The sequence consists of a series of bearish rod

- The occurrence of a strong bearish road

- Volume does not fall on a pullback

- Deepness of pullback

- How pullback came

- Pullback flops to bounce fast

Powerful pullback support to follow the trading range or reverse the tendency or try to oppose the trend.

Types of pullback

The real actions are time or cost improvement. However, they also indicate a variation order continuity, and the contribution relies on the tendency kinds.

TIME CORRECTION

Optimization of cost

- A powerful drift: You can have pullbacks in powerful tendency markets that are typically in stock without a horizontal, low instability trend. As the pullback is low, it is not easy to spend time on your entry pullback. Rather, you can try for a breakout to trade, or get an entry at a lower time limit.

- Healthy drift: It is a strong and a weak trend. There is a hope of pullbacks towards the SR level.

- Weak drift: In weak trending markets, there are steeper pullbacks typically retracing towards major help and confrontation.

As the trend continues, this stop becomes too far from the place of loss. The retailer is taking profit to decrease the risk. The market retreats and gets in the way. Once the bulls are convinced that the bear will be unable to oppose the trend, the bulls will purchase again with a hard stop loss.

Must Read: Bull Flag Stocks Intraday Trading Strategy – Learn Stock Trading

The cost drift

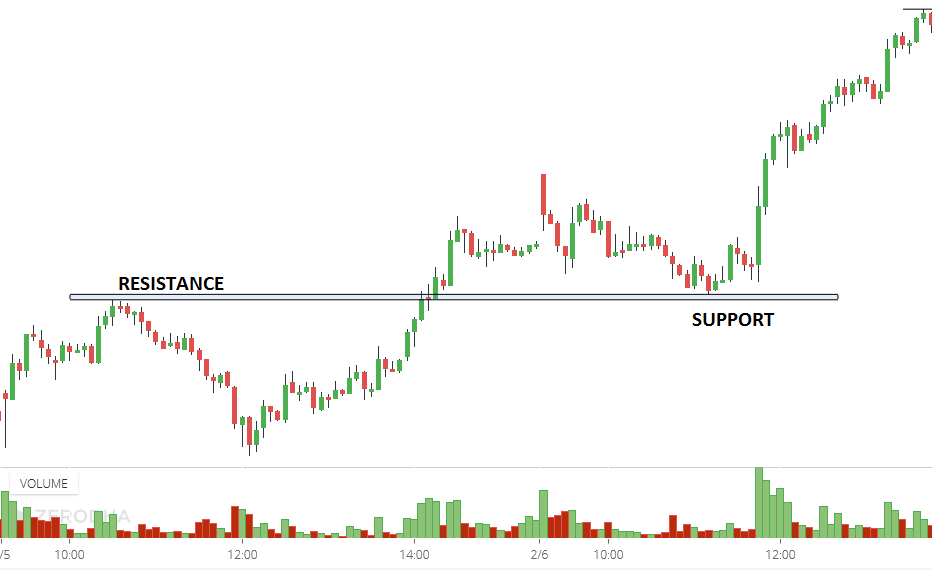

Price correction, right as the cost action reverses the underlying trend, this correction is from the price and action towards the SR level.

Complex Pullbacks

Such pullbacks occur when the price steps into a stable point in any structure. After that, it stays stable for a while before it starts again. No one can guess how long it stays stable before it starts moving again. Usually, create a permanent pattern as follows:

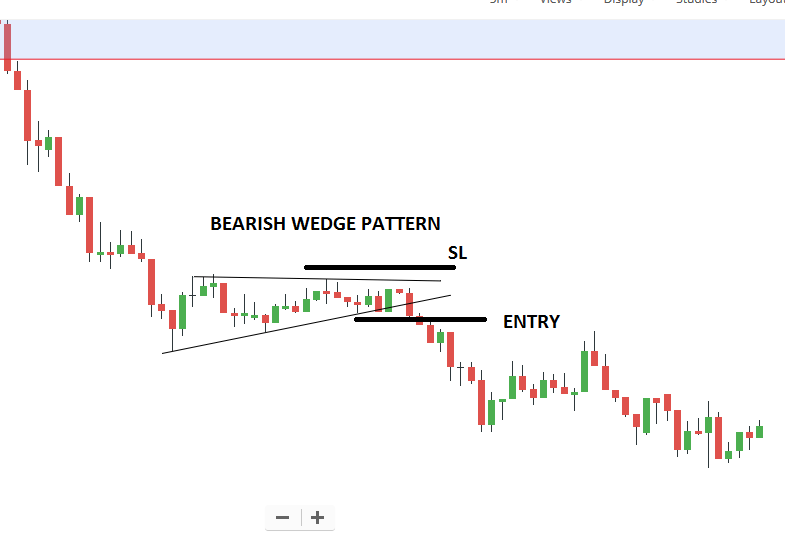

- Rising / falling pitcher pullback

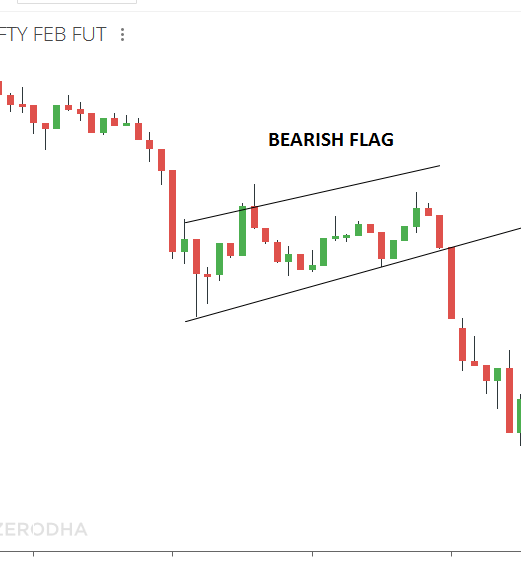

- Rising / falling flag pullback

- Banners playback

- Widening wedge pullback

It ends at:

- Supported by the previous confrontation

- The resistance turned to the previous support.

- Towards dynamic support

- Towards dynamic confrontation

- Towards a Fibonacci retrieval

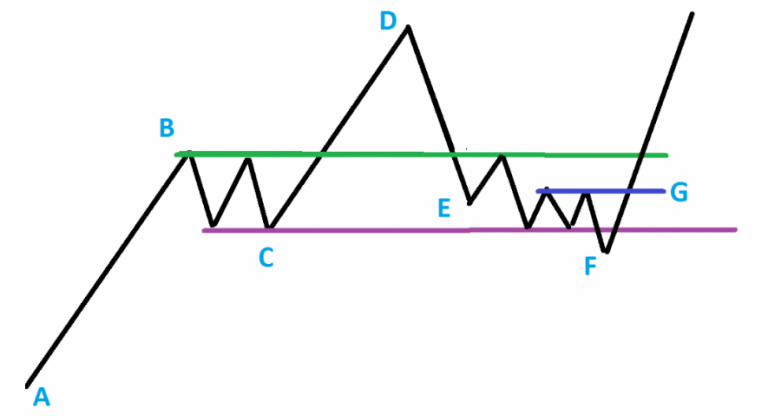

We can say that B points are most important.

- Resistance turned into support

- It gives a stage for a technical test in a Fibonacci 50/61.8 percent correction;

- It gives a point for bulls and bears to compete with to find the correctional command,

While waiting for stability in support, it is inevitable to miss a turn from time to time. In fact, it happens quite often. But it will also save us from a much faster death.

The entry listed above F does not essentially relate to the higher economic entry of E. First, the stability below F shows more approval of the possibility of an opposition that is good. Security and target levels in relation to entry-level are also important to see.

This diagram shows the fact that we want to avoid it while waiting for stability. At this point, the pullback D-E reversal performs inversely. Technically speaking, the B level once again happens like the most likely applicant for change. But the instant short at e phase attacker suffers severe distress before reaching a real turn.

Keep it in mind, prices underwent a technical test before reversing again, but instead of using a previous level of support to bounce off (B), the market turned around.

How to enter your trades on a pullback

There are many ways to enter your trades via a pullback. Here are some entry techniques you can us

- Reversal candlestick patterns break out

- Continuous pattern TL breakout

How to enter your business on a pullback?

- Inverted candlestick patterns are broken

- Continuous pattern TL breakout

Reversal pattern

Reversal patterns represent high/low price rejection, supportive for entry inspiration. They can be pin bars, attached bars, and external bars

Continuous pattern TL breakout