In the financial markets and forex, the traders can trade by selling and purchasing. It is named as a long or short trading strategy. The term long refers to the purchase, and short refers to vend. In market updates, these two names are uttered as shorting EUR/USD or purchasing USD/JPY. If a trader opens a purchasing trade, he goes long for that pair. On the other hand, if he purchases GBP/USD, he goes long for the British pound and short for the Dollar.

Characteristics of hedging strategy

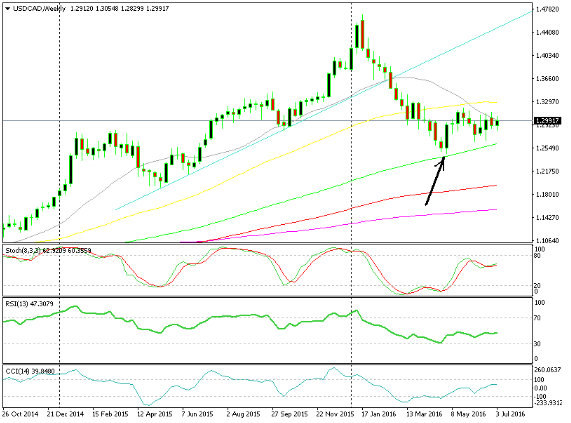

At the start of May 2016, a long term purchase forex signal was successfully opened. This month, USD/CAD, after two years of the highest trend, was efficiently reviewed. The cost reached the 100 moving average in green. Therefore, the trader focuses long on the USD, contradictory to the CAD accepting to achieve 300 pips from it.

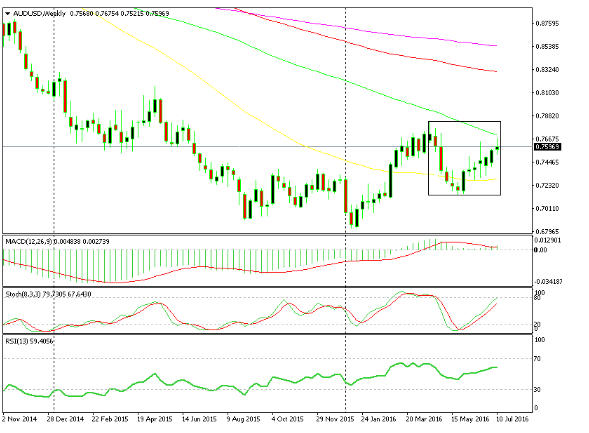

When a trader trades EUR/USD at the Brexit referendum day, it means he shorted a forex pair. Since this pair was about 1.14-15 points, the trader cannot expect the victory of Brexit. When Brexit won in addition to GBP, the Euro suffered also. In this way, the revenue in Euro short forex signal is activated, offering 280 pip revenue.

Like government and central banks, some traders go long on financial tools and do not focus on shorting anything. They do this to support the economy. Several traders think it takes a long period to rise as after the global economy stabilizes. Hence, their trading strategy went on long.

On the other hand, some traders focus on the weak point of financial tools, wait when things went wrong, and send varied exchanges and financial tools down the drain. Therefore, they take short trading.

There is also a third party of the traders who apply both points in different financial tools. When the trader’s forex study is on the side of USD to keep him secure from the loss, he purchases one pair and trades the other.

But it is also important to know which pair the trader should sell to create revenue.

Consider this example to understand it:

Finally, hedging strategies are highly profitable forex trading strategies to secure from loss and increase revenue. This is the main reason that these are known as hedge funds, and they are widely used by top trading organizations. When the situations are in favor of the trader, and he is using the hedging strategy, then it will guarantee him an unexpected revenue.