Fair value a trading strategy used in various financial markets. For example, in the stock market, several brokers purchase or trade shares of a company based on a fair value plan. Fair value strategies are also very common in the upcoming market.

According to the Western Accounting Standards of IFRS, fair value is a sum value of a company, analyses all the structures, machinery, construction, financial tools and its outcome concern, funds of a company, liability, and all the attentiveness that is payable until these debts are repaid. Fair value in the next market will be taken to be a balance between the spot cost of a futures agreement and the concern earned from the agreement. Future traders purchase and trade if there is a change between them, and they think that the break will be achieved.

Dual economies are evaluated by a fair value strategy

A fair value trading strategy is broad in foreign currency, but most of the dealers have no idea that they are using it. In stock, someone review all the machinery of a company get its actual value and then divide that value by the total number of all shares to determine either the market value of the shares is correct.

In foreign currency, someone struggles to determine the company’s value and economic structure. It may seem complicated and difficult to guess the actual value of a country’s economy. But, in reality, it is simple. It is taken as an essential forex strategy because as it encompasses economic data and occasionally the political state of one country while equating them with the same machinery of another country to find out the bright future in a short time to average period.

How to implement the fair value trading forex strategy?

In order to apply this foreign trade strategy, someone must know some basic points of the economy, i.e., the GDP progress of the two countries whose exchanges are being focused on trading with. Another essential thing to know what the unemployment rate is and what its tendency, and to view the increase and outlooks also. You can get this number online in several financial or foreign currency portals.

Related Strategy: Elliott Wave Theory And Strategy – Learn Forex Trading

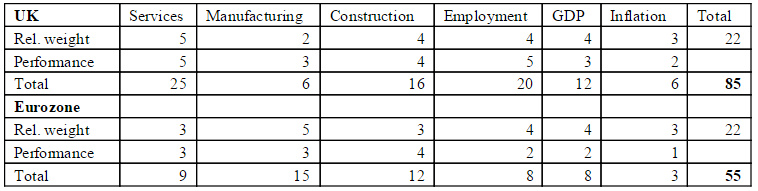

From this, it is also clear that the essential characteristics and parts of the two economies and the score evaluation based on the status of the country’s overall economy. As if someone is matching the UK with the Eurozone in order to trade the EUR / GBP, 10 points will be awarded to the European industry, as this zone is crucial for most of the major Eurozone countries. On the other hand, the UK will probably be allotted only two or three points, as this sector just accounts for 10% of the UK’s GDP. Conversely, someone should award the UK service sector a high score as it is important for the UK economy.

After selecting the most significant segments and mechanisms of both economies and ranking their respective economies based on the rank of each sector, someone should judge what the performance of these zones was? After it, points are awarded to each sector according to work done, and the status and performance points for each zone are increased. In the end, all the fields were merged. It is definitely not an algebraic fair value formula.

Comparison of UK Economy and Eurozone in the Light of Fair Trade Formula

To keep the two economies in balance, the overall weight of all the machinery that makes up the economy should be the same. Such as, when the industrial sector in the UK accounts for just 2 points out of a sum of 22 of the actual weight, the performing zone will form for it. Hence, the actual weight for both economies is 22.

Next, someone will assess the work of each zone and awarded them 1 to 5 according to the current months’ work and trends. Keep it in mind that there may be a strange month of abnormal performance, either progressive or destructive, but it may be the result of other factors. In such situations, it will be good to see the largest inclination of the last 6-12 months. After that, you multiply the weight of each field to its work for overall points and add the points of all the fields to get the overall score of that economy.

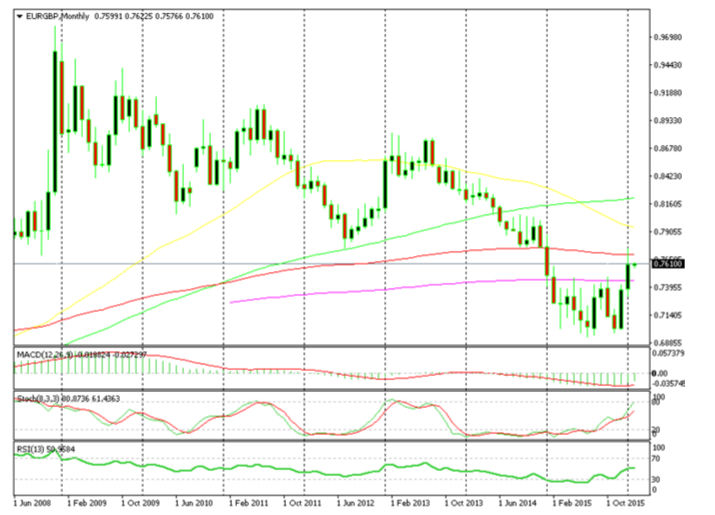

Income rise, costs, trade balance, and production, etc. can also be used for it as global milk prices for New Zealand and Kiwi are of much interest, so it should be included while estimating this economy. In such a situation, the overall score indicated that the UK economy performance is much better in the comparison of the Eurozone economy. It has been the case from several years after the 2008 global financial disaster. If someone used the fair value strategy several years ago and made such an assessment, he would have made about 3,000 pips by the start of this year.

Economic downturn downtrend the EUR / GBP

Once someone knows which economy is working well, the short-term or the medium-term situation can also be traded. The short term here refers to the big economic picture that lasts from a few months to 1-2 years. In the case of EUR / GBP, you could sell the pair during the holidays each time the stock reached a level higher than the stock indicator, and the trade would close after several hundred pips. The medium-term varies from 2-3 years to 10 years, so the medium-term fair price forex strategy falls within this range.

Some more information: Fair Value as an Efficient Trading Strategy – Learn Forex Trading

Hedge funds, pension funds, and investment banks favored this forex trading strategy. For medium-term trading, someone can easily open a trade order at the highest and maintain a rank at the bottom. Moreover, he can also open an order at the highest and increase it with each retreat as well. The fair value trading forex strategy is effective for large positions, but you have to evaluate the structure of both economies every few months must be reanalyzed as over time, the sectors or other machinery can be changed. Currently, inflation is crucial for the Eurozone, but in six months, the service sector may be the most crucial sector. Due to this, the fair value strategy is a significant expert.