Buffett and his right hand Munger famously claim that risk management is not important and given their status, this statement has been widely adopted by many investors. Clearly, Buffett and Munger have shown that they are able to generate great returns over the past decades. But, have you ever wondered how diversified Buffett’s portfolio really is? We were wondering the same and analyzed it and also were able to learn what investors can learn from Buffett. We did analyze his portfolio using the Portfolio Risk Calculator by valuee.io , a simple tool with which investors can easily calculate their risk performance and also learn how they can improve overall risk and with that also returns in the long term.

What is the yearly volatility?

Yearly volatility is a number that expresses the magnitude of movements in your portfolio. In other words, it expresses how likely your portfolio may go up or down. It is important to understand that this number expresses the volatility of all positions that you have in your portfolio together, not just one stock. And it is calculated by considering all the individual positions and also the relations between those, also called correlation between stocks. The relation between stocks is where risk management becomes interesting since it can be used to lower the volatility of the portfolio without reducing opportunity. This effect can be used by every investor!

Buffett’s Portfolio

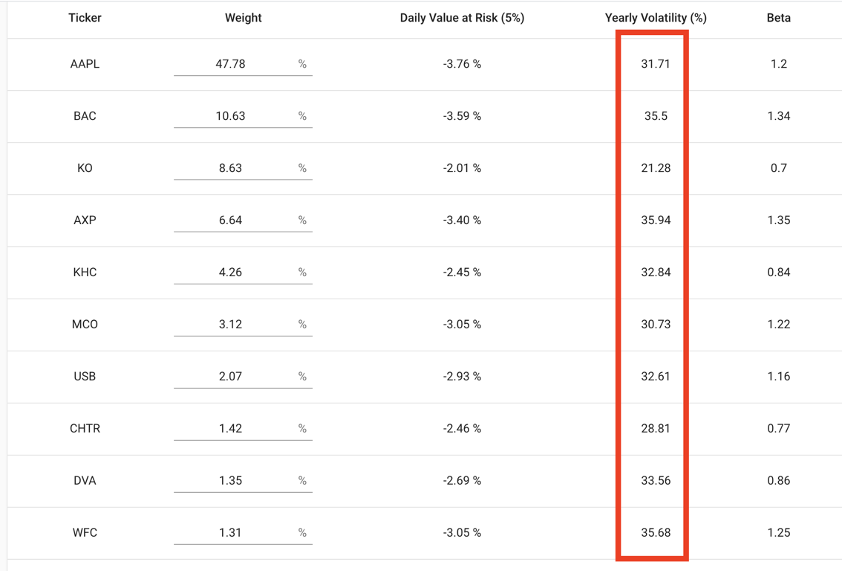

To analyze Buffett’s portfolio we took the latest reported portfolio which is Q3 2020. In this portfolio there are 49 individual stocks. The biggest position is Apple with reported weight 47.78% and overall the top 5 positions make up for almost 78% of the total portfolio already, which you could argue is not very diversified. However, the power of diversification is still there to help Buffett. Overall his portfolio has a yearly volatility of only 24%, thus he can expect that his portfolio will change value of 24% over the course of a year. This number is fairly reasonable for a stock only portfolio, with very high allocations in just very few stocks. Almost all individual positions have a higher expected yearly volatility (compare Image 1), but the overall portfolio volatility is lower than the individual stocks. This is very interesting isn’t it?

Image 1. Subset of Buffett’s portfolio: Most individual positions do have high volatility. But the total portfolio is much lower. Source: Valuee.io

Buffett’s portfolio is diversified

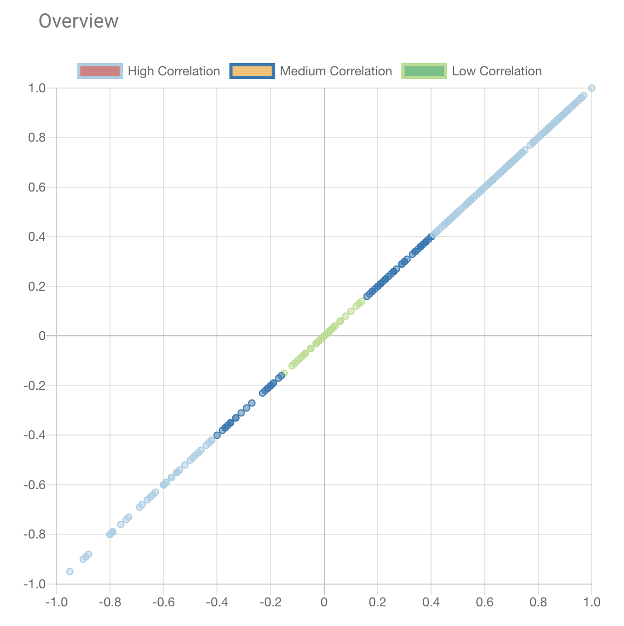

Although Buffett claims that he does not diversify his portfolio seems decently diversified, given the fact that all his stocks balance each other. When looking at the correlations of the stocks it can be seen that Buffett mixes high and low correlated stocks to overall get to a balanced portfolio. Roughly 65% of his positions are highly correlated, whereas the rest is either medium or low-correlated (see Image 2). Thus, although Buffett overweights some few companies, he still has a relative normal portfolio volatility, all through the power of diversification.

What we can learn

Looking at the results, it’s obvious that every investor can highly benefit from diversification, which is not just the weight that an individual stock has, but the interplay of all positions in the portfolio, which you can only get to if you crunch some numbers. If you are interested how your portfolio ranks in terms of overall risk performance, try out the free portfolio risk calculator by valuee.io. You can get deep insights into your portfolio and understand how the stocks that you own move together. Furthermore, there are optimization tools available for registered users through which you can learn how to allocate your money to have the lowest volatility possible, or the best risk-return ratio, based on your current portfolio.

All investors should consider the power of diversification and should also know the relationship between the stocks in their portfolio.

Image 2: Overview of Correlations in Buffett’s portfolio. The correlations are balanced for the whole portfolio. Source: https://valuee.io