Related news

Wall Street enters a quarter that it predicts frenetic in terms of the number of premieres of new listed. Despite the fact that the final stretch of the year there used to be a very crowded in these terms, it seems that the coronavirus has also altered this metric. More than a hundred businesses already waiting for their turn to debut in the next few months in New York.

The forecasts are so bulky that point to the the end of the year more prolific in debuts from the era of the ‘dot-com’. In fact, the recently completed third quarter has already managed to reach this height.

And that’s the start of the course has always been a period most favorable for these purposes. Something that, on the other hand, gives arguments to those who advocate that the assessments of the technology have a justification each time more complicated.

Funding

Two are the factors that analysts point to as engines of the same thoroughfare to the New York Stock exchange. The first of them has to do with the need funding many companies are experiencing as a result of the contraction of the economy.

And is that the crisis has also led to banking american raise the bar in the granting of credit so as not to be trapped later on a ball of snow late. A fear before which you can do the open bar of liquidity, which was decided by the US Federal Reserve (Fed).

More benefit

In the second place, the appetite for investments of greater risk once they have proven that, in most cases, the worst forecasts have not materialized for companies that are already listed. The accounts and business forecasts that have been published in the last few months have managed to take advantage against the worst of the threats.

And, what is more, the forecast for the fourth quarter are more than friendly. Analysts they have improved their estimates of profits for the S&P 500 for the first time since the second quarter of 2018. In addition, according to data from FactSet, which has been done in 4.1%, from an opening mark of 31,78 dollars per share up to the 33,08 us $ for title we now put the average of the index.

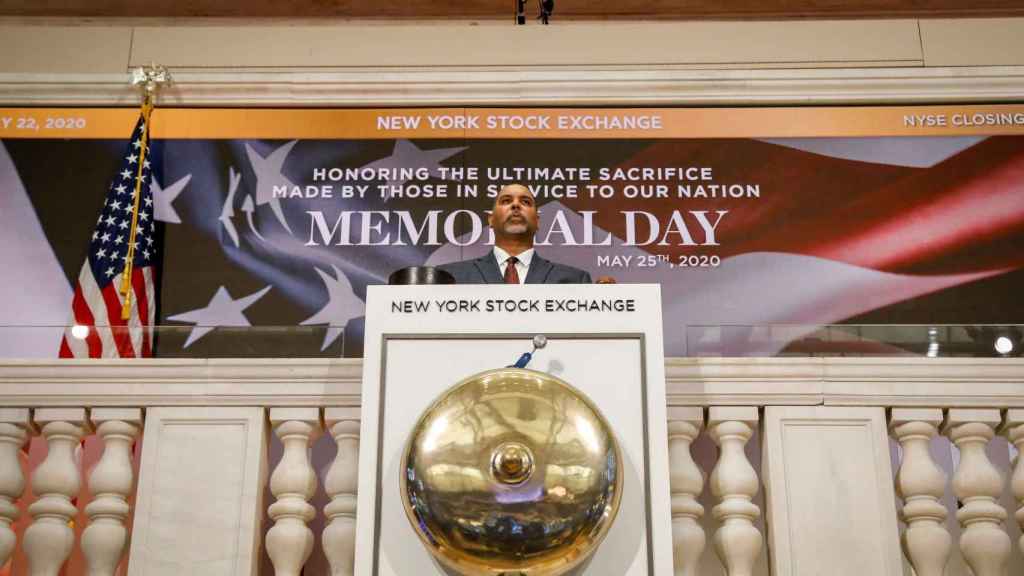

A an ex military man rings the bell sign on the New York Stock exchange.

Thomson Reuters

In addition, there is a third factor that helps to that the volume of new releases in the american market of reference is much more significant than in other places.

Unlike what happens in Europe, in Wall Street listings direct, without a placement immediately prior actions, are quite common and often shorten deadlines and streamline procedures with views of a subsequent issuance of shares as would be given with all the guarantees that you will presuppose to a listed company.

Premiere the rise

And there is yet another fact that would have spurred the interest of companies to make the leap to the floor. The prime minister concluded during the third quarter of the year have delivered with a rebound average of 39% in its first day of trading.

This percentage would have become for many boards of directors are fearful of starting with a hiccup at all a guarantee and impetus for launching a premiere is expected to shine in the mecca of finance. However, what is certain is that this bounce has cheat, because it explains the preference which -according to criteria of caution – have had the most debutants for release in the lower part of the range of valuation for the entities placement agents on duty.

Of time, over the third quarter of the year have been 99 companies that have initiated formal procedures for debut over the next few months. Although it is normal for some to stay by the way, the most common thing is that once you start these procedures with a view to go all the way to the red carpet at the day of the ringing of the bell.

To take into account the magnitude of the number of applications registered over the last few months, it is worth mentioning that the figure is an increase of no less than 68% compared to the same period in the past year.

Turns Playboy

And needless to say, that then only some predictors were reluctant to talk of recession and no one expected that a few months after started to be known as ‘viruses of Wuhan’ out to be the occasion of a pandemic and a confinement almost global.

Although the majority of premieres be companies little known, especially by investors from this side of the Atlanticalso there are names waiting for more than popular. Two of the latest to have announced its release in the u.s. stock market are technology McAfee and the emporium for the adult entertainment Playboy. In truth, there were two revivals, both of which were listed some time ago.

In Europe, the picture remains much less promisingalthough they appear the names of candidates for the premiere. In the case of spain, beyond the socimi is obliged to make debut in market regulator, the only debut scheduled is that of the technological Cuatroochenta, which is expected to debut in the market BENCHMARK Growth for the mid of this month of October.