The cryptocurrency markets remain in a very awkward position. Overarching macroeconomic sentiment does not favor bullish momentum whatsoever. Things may not turn around for Ethereum yet as the exchange-related metrics paint a bleak outlook.

Ethereum Exchange Outflow Dips Hard

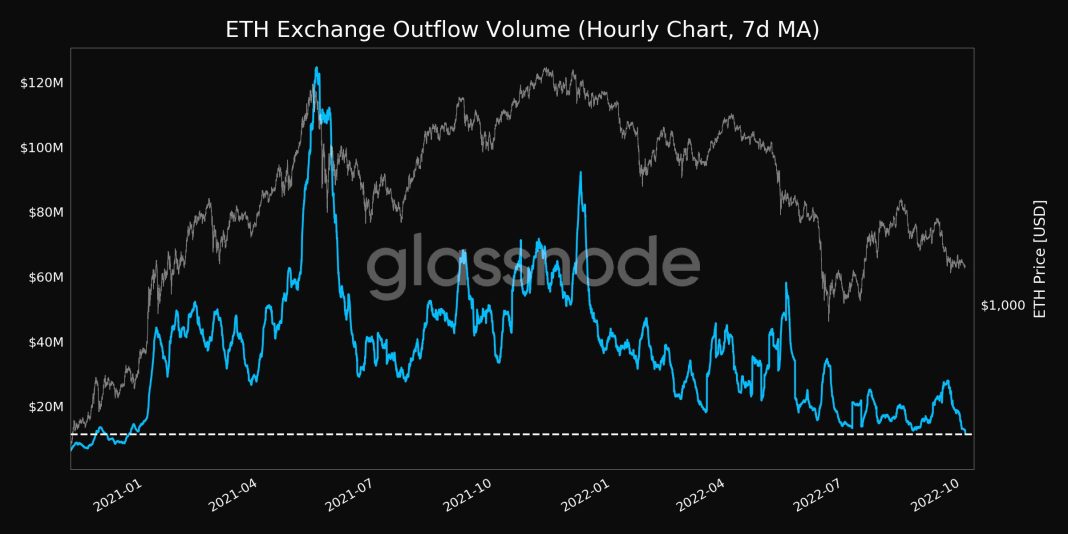

There are many ways to determine how traders look at specific crypto assets. They will often showcase overall sentiment through exchange withdrawals and deposits. Higher exchange outflow means more coins are withdrawn from trading platforms than deposits. Maintaining a negative outflow can build bullish momentum, although Ethereum finds itself in a different position.

Per Glassnode, the second-largest cryptocurrency by market cap hit a 21-month low in exchange outflow. In essence, that means there are far fewer ETH withdrawals than before. Such a dip is not unexpected, as the metric has been going downhill for a while. THere have been some peaks in recent months, but nothing overly exciting.

In addition, there are various reasons to keep ETH on an exchange. Most platforms allow for ETH 2.0 staking or exploring DeFi opportunities. Exchange users can put their Ethereum balance to work without moving it off the platform. It is an appealing option for novices and experienced users. However, it will also reduce the overall netflow.

Exchange Deposits Dip Too

The above may seem worrying for those hoping for an ETH rebound. However, the number of addresses sending to exchanges is at a one-month low. The number of addresses does not indicate whether users send fewer or more funds to trading platforms, though. Therefore, there is no reason not to at the current network fees if one intends to cash out ETH holdings.

With fewer deposits and fewer withdrawals, the market remains at a standstill. That may explain why any minor uptrend is pushed down violently and quickly these days. Ethereum and other crypto assets have no clear upward path for now. That may change if the deposits dry up further, although that is mere speculation.

One crucial other metric to explore is the Ethereum Fear & Greed Index. It remains at 38% FEAR, indicating market participants remain very cautious. Additionally, there is negative sentiment toward the price, technical outlook, and market dominance. However, whales show no desire to cash out, and exchange order books look healthy.

Under the current market conditions, accumulation is still a solid choice. Anyone who believes ETH should have a higher value will keep growing their Ethereum portfolio. For everyone else, the future outlook remains up in the air. No immediate price changes appear imminent, but more bearish pressure remains somewhat likely if it were to happen.

The post These Metrics Indicate Further Pain Looms Ahead For Ethereum (ETH) appeared first on CryptoMode.