Financial market brokers, small or large, private or official, depositor or entrepreneur, just focus on restricting the business threats. They also concentrate on boosting up the chances of earning using risk control strategies. The feasible hedging strategy is an important strategy among several other forex trading strategies.

The feasible hedging strategy reduces business threats. It also supports improving your chances of winning. Large companies required this strategy as an integral part of their procedures, particularly in cost actions. Moreover, investment funds are entitled after this strategy as ‘hedge,’ mostly buyers, and that’s why they are known as ‘hedge funds.’

Hedging Strategy

Simultaneously buying and selling two different devices is known as Hedging. The traders can do this in distinct markets as options and stocks or in Forex.

To control the threat of loss, the traders should purchase insurance. On the other hand, the hedging strategy helps to avoid insurance charges. It was firstly introduced in 19thc in agricultural futures markets. This strategy comes to secure the dealers from possible threats that occur due to the variation in the cost of agriculture merchandise.

Hedging Forex Secure From Loss

It is a common strategy that supports the traders to energetically hedge in Forex. He must have to select two confident, connected pairs as EUR/USD and GBP/USD or AUD/USD and NZD/USD. The traders also control contradictory sides on both. Hedging strategy helps to secure from loss in risky situations. PHP BTC

The technical and central study supports this strategy to make it more profitable as well as safe. It will make you money-making when you work in contradictory positions on similar pairs. In the decision of a hedge, a broker must analyze to find two similar pairs that will really not perform in a similar direction, moving upwards or downwards.

Condition 1: A Hedging Strategy For GBP/USD and EUR/USD

From this chart, it is clear that at the start of May, Euro and Pound were at a peak in contrast to $ 1.40 and 1.70 individually. These stages will work as a reasonable resistance.

With the EUR / USD and the GBP / USD increasing for more than a year, correction or reversal has been delayed. At 1.40 and 1.70, both pairs seemed a little sensible. But, it is the highest threat to enter two short positions related to each other, or not even a short entry work will be very high. In order to develop an appropriate hedging strategy, the trader should judge the weak pair, the shortest and the longest as well.

The EUR / USD had run a 1300 pip from the lowest for more than a year, while the GBP / USD had traveled 2,200 pip. Hence Euro is weak as compared to the pound. EUR/USD would be in a stronger position when the dollar was supported.

At almost the same time, both pairs reached the peak and began to fall quickly. EUR/USD fell about 500 pips, and GBP/USD fell about 300 pips. If we shorted Euro and went long on Sterling with one lot each, we would have taken 5,000 USD in the first and lost 3,000 USD on the second pair. This trading plan leaves us with a 2,000 USD profit from an extremely effective hedging strategy.

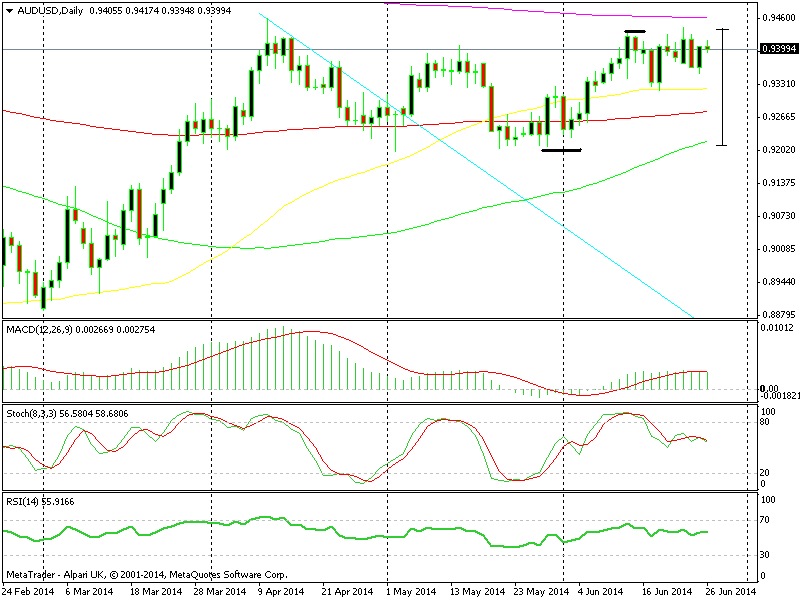

Condition 2: Product Pairs

This weekly chart of AUD and NZD in contrast to USD shows that AUD/USD was in the highest downtrend of about 2,000 pips around 2,000 pips. Around 800 pips, the review was effective. It was the situation when NZD/USD was at a peak with fast actions as compared to past failure.

Hedge wrappers

In the end, we can say that Hedging does not make suggestions about the specific currency pair movement. It is just a technique that supports the work of most demanded market dynamics to create revenues. Hedging strategy can also offer trading forex insurance strategy. Before starting the work of hedging forex, the broker must also judge the role of other trading strategies.