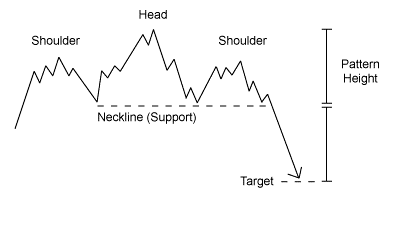

The ‘head and shoulders trading’ pattern is one among many recognizable and tradable chart patterns. In foreign exchange jargon, they may be referred to as “shampoo” because of the shampoo emblem of the same call. Head and shoulders trading forex patterns encompass an excessive height in the middle and two double peaks on both sides of that one as can be visible inside the instance under. The better top is the head, and the two lower ones are the shoulders. The sample itself looks as if a leader among two joints; as a result, the name.

Head and shoulders buying and selling

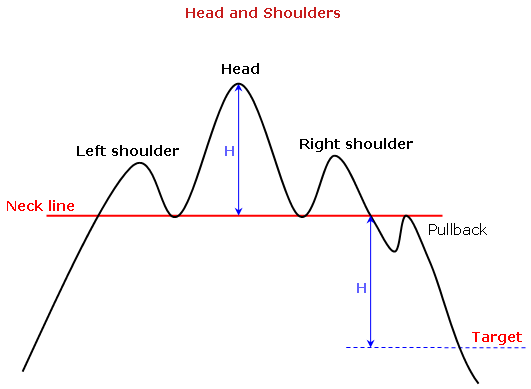

Head and shoulders styles turn out to be relevant while the neckline is penetrated. Once the neckline is broken, we may additionally look to open a brief role on the opposite facet of the pinnacle and shoulders trading indicator. BTC to PH

Some traders input at once, while others opt to enter on a pullback and retest of the neckline. The latter alternative is safer because now we understand that this isn’t always just a fake-out. The wide variety of pips targeted on this approach is approximately similar to the number of pips between the top of the head and the neckline. When the market is feeling right, and there may be extra room to head after attaining the target, we might aim for more significant earnings and let the other run.

Head and shoulders trading samples include one high top (head) and two decrease peaks (the shoulders).

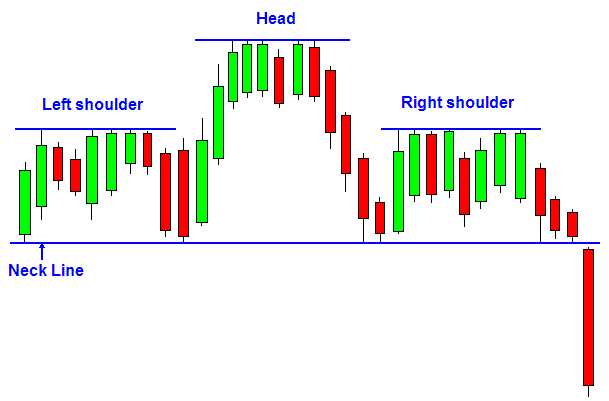

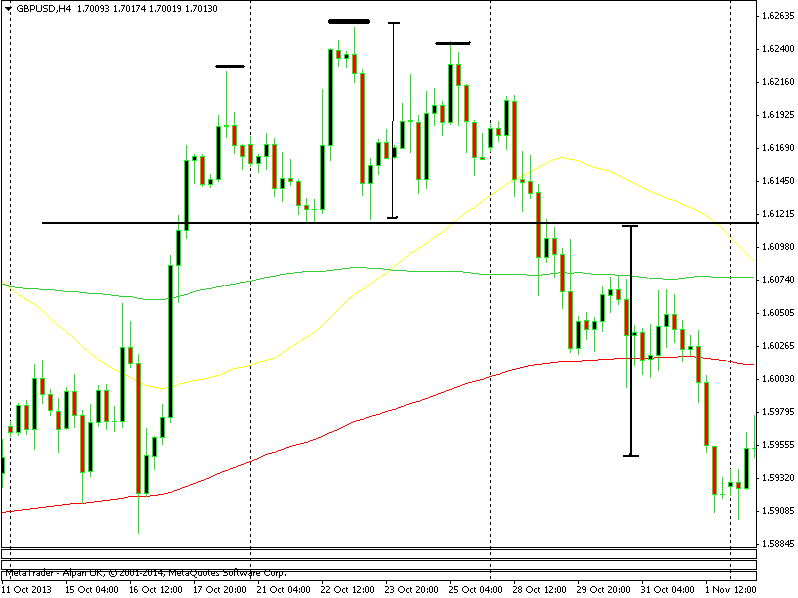

Head and shoulders forex pattern on a regular candlestick chart

The pictures above are self-explanatory and permit for apparent recognition of the head and shoulders buying and selling sample. Don’t count on the actual charts to be as clean — they may offer more of a challenge. To change those patterns, we must spot them in real-time as they manifest, not even after they’re irrelevant.

The lowest line typically referred to as the neckline, is simply an assisted stage. It may no longer always be a direct line, but an ascending or descending sequence. The slope aspect to the neckline makes it plenty greater hard to identify; as a consequence, we must focus on the larger photograph. Junior buyers should likely switch to a line chart, which makes some patterns extra visible, rather than the candle chart. The picture underneath is an actual chart displaying a head and shoulders forex pattern. Recognizing the head and shoulders trading sample in actual-time and trading it efficiently tons extra tight than shown in the illustrations.

Spotting head and shoulders forex styles

As mentioned above, the neckline ought to be broken for the pinnacle and shoulders pattern to be usable, even though real-lifestyles trading doesn’t comply with textbook policies so strictly. We must be flexible and intelligent to spot these patterns as they’re forming, to reduce the danger and maximize the income.

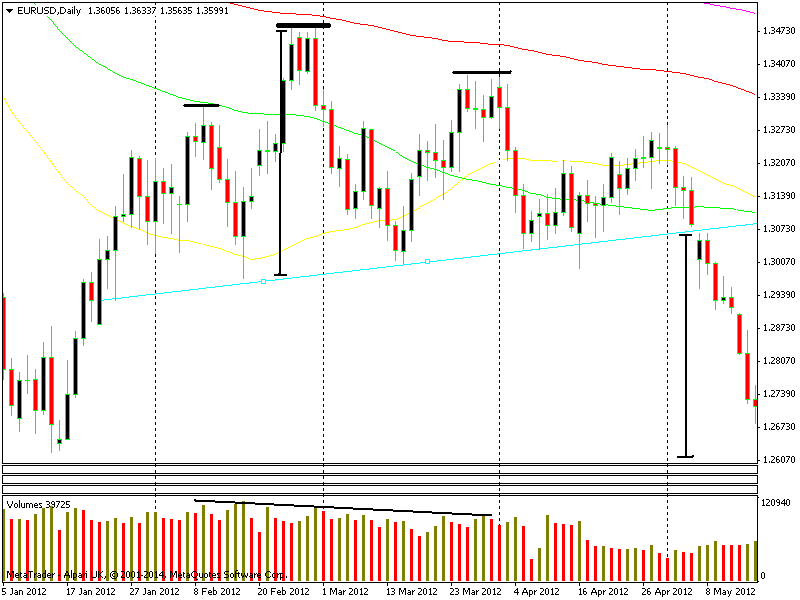

One trick for early sample recognition and coming into high possibility winning trades is to study the volumes. No matter the time-frame, the amount is supposed to decrease with each top. Of direction, as with maximum matters trading, this isn’t always the case. The lower quantity on the second height, that’s the pinnacle, way that customers had a strive at the upside, but without plenty of force. As a result, the rate eventually is going down.

When we’re at the pinnacle of the second one shoulder and extent is low, we should test other signs together with RSI and stochastics to peer if the pair is overbought. If that’s the case, and if pins, dojis, or inverted hammers are forming on the candlestick chart, we’d enter the change with a forestall above the top. This manner, we nearly double the earnings target and boom the risk-praise ratio. The chart underneath illustrates using this head and shoulders buying and selling strategy on an ascending pattern.

Quantity decreases with every height

Inverse head and shoulders

‘inverse head and shoulders’ patterns are the alternatives of head and shoulders. All guidelines practice, but they’re in reality upside-down. In this situation, the neckline additionally serves as resistance. This indicates we need to look to buy upon the ruin of the neckline. Like head and shoulders, they’ll be instant, ascending, or descending.

Inverse head and shoulders trading is precisely the equal but upside-down.

Head and shoulders styles are not a foreign exchange buying and selling method on their very own. However, they do help us to get a higher photo of what goes on and what’s going to show up next. Being capable of spotting these styles may be the difference between a triumphing change and a dropping one.

As you gain more significant experience as a dealer, try incorporating as many of these techniques into your buying and selling method basket as possible. Possibly effects are more desirable performance and an opportunity to make more money.