The anticipation of crypto exchange traded funds (ETFs) approval in the United States continues to influence price performances of many cryptocurrencies. The Ethereum coin is one of the cryptocurrencies that has benefitted much from the ETF hype. This is particularly so, considering that BlackRock, the world’s largest asset management firm, has filed for an ETH exchange traded fund.

This analysis delves into Ethereum crypto’s recent price performance as well as its general network activities. We will also discuss the surge in Ethereum NFT transactions and the implication of Binance money laundering exposure on the future of ETH and stablecoins.

Ethereum Surpasses $2K in Anticipation of ETH ETF Approval

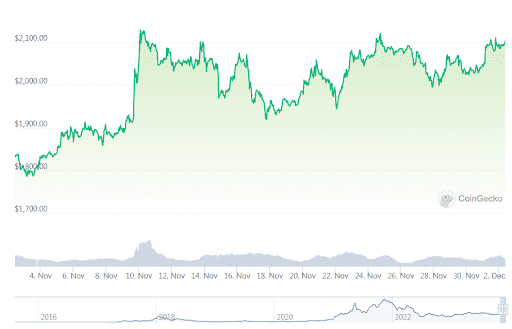

On 23 November, the data shows on Gate.io Crypto Exchange that the Ethereum price surpassed $2K as the market anticipated the ETH ETF approval in the United States. The other contributing factor to its recent price spike was an improvement in its network activity.

Although ETH retested the $1,930 support level on 21 November it surged past $2,000 two days later. During the third week of the month, the ETH price increased by 2.5% while its market capitalization grew by 0.5%. The Ethereum upward trend has not receded as the price continues to rise steadily.

As of 2 December, the Ethereum price is fluctuating around $2,100 as the following diagram indicates.

Ethereum Price Movement – CoinGecko

As you can see in the diagram, since 10 November the Ethereum price has been trending above the $1,930 level most of the time. Apart from the anticipation of the approval of crypto ETFs, improved decentralized application performance and the increased NFT activity have contributed to its impressive performance.

Improved Ethereum Network Activity

Several Ethereum dApps have recorded impressive performances since the beginning of November. For example, by 23 November the dApps’ total value locked (TVL) stood at $26 billion, representing about a 5% increase from the previous week.

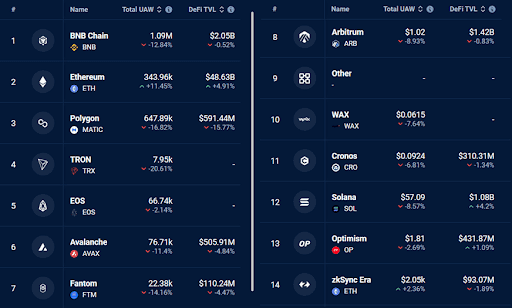

In terms of TVL, the Ethereum network came second behind Binance Smart Chain (BNB) as the next picture shows.

Top blockchains by active addresses and DeFi TVL – DappRadar

The Ethereum network also generated much revenue during November as a result of the dApps’ great performance. Although Bitcoin is much higher than Ethereum, the two blockchains generate similar revenues.

Specifically, bitcoin has a market cap of $728 billion while Ethereum has $248 billion. However, the bitcoin network has generated $57.5 million in network fees while Ethereum racked in $54.3 million within the third week of November. Note that the Ethereum revenue does not include fees from Uniswap, Lido, Maker protocols and other related platforms.

Ethereum NFT Surge

The expectation of a possible ETH ETF approval in the United States affected Ethereum activity in various ways. For instance, during the third week of November there was a remarkable increase in the volume of NTF on the network. A good example is what occurred between 23 and 24 November.

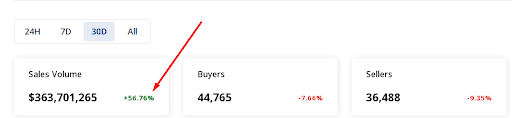

During a 24-hour period the network recorded NFT sales volume of $12.6 million. On-chain data available on Cryptoslam confirms a huge increase in NFT market sales during November. It indicates that during that month NFT sales increased by over 56%. The following screenshot shows the details.

NFT Sales Volume – Cryptoslam

According to Cryptoslam the most popular NFTs are Bored Ape Yachts, Pudgy Penguins, Azuki and Crypto Punks. Definitely, their high trading volumes have driven the ETH NFT market up.

Such a performance indicates that Ethereum remains a preferred blockchain for NFT projects. Another possible driver of the current Ethereum network performance is the reduction in regulatory concerns related to the 2015 ICO. Now, the market believes that the SEC may set aside that issue.

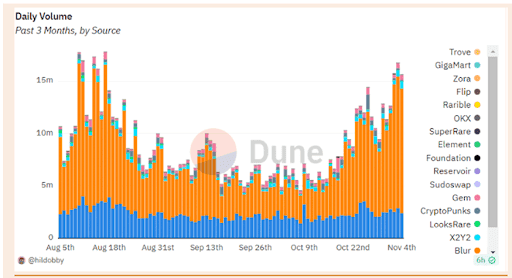

Also, data from Ambcrypto shows that the increase in NFT sales volume started in mid-October as the next graph shows.

NFT Sales Volume – Ambcrypto

In related news, Dappradar openly claimed that the downtrend in NFT sales is over. It said, “The yearlong downward trend in NFT trading has been broken.” DappRadar’s comment came after the NFT market recorded an increase of 32% in October.

A New NFT Marketplace on the Horizon

The increase in NFT sales on the Ethereum network may relate to the blockchain news of a possible launch of an ETH NFT marketplace. Magic Eden and Yuga Labs are collaborating to launch a new NFT marketplace. The major aim of the marketplace is to ensure that NFT creators receive the right royalties.

Magic Eden said, “We’re thrilled to announce that we’re partnering with Yuga Labs to launch a new ETH marketplace by the end of the year. This will be the first major ETH marketplace to honor creator royalties for all ETH NFT collections. Without creators web3 can’t exist. Here’s to supporting creating and building a better future together.”

Both Yuga Labs and Magic Eden believe that a viable NFT ecosystem needs the support of many NFT creators. Without active and supportive creators the web3 economy may not thrive as expected.

Magic Eden has promised to share a portion of its secondary market sale with the creators, something which should incentivize them to be more innovative and creative. The news of the NFT marketplace is likely to maintain ETH upward momentum for the next few weeks or months.

Possible Effects of Binance Money Laundering Exposure on ETH and Stablecoins

Binance’s admission that it perpetrated money laundering may have a strong bearing on major cryptocurrencies like ETH and stablecoins.

For context, Binance and its founder Changpeng Zhao admitted that they failed to implement an effective anti-money laundering program, which allowed U.S sanctioned individuals and terrorist groups to use the crypto exchange.

As a result, Zhao and Binance entered into a settlement with The Justice Department, Commodity Futures Trading Commission (CFTC) and the Treasury Department. The settlement requires Binance to pay a penalty of $4.3 billion.

However, the cryptocurrency market is uncertain about the effects of Binance’s money laundering exposure on the sector. Even if Binance remains operational things may never be the same for the sector.

The closure or downsizing of Binance crypto exchange may have long term implications on major cryptocurrencies like ETH. For example, Binance leads in terms of Ethereum spot trading volume. Since it accounts for about 30% of all ETH futures contracts’ open interest, the closure of the derivatives may lead to much outflows which may negatively affect their liquidity.

Following Binance’s plea of guilty many crypto investors withdrew their holdings on the exchange which led to much outflow. Unless there are clear signs that the situation is totally under control more crypto investors may withdraw their crypto assets in coming days and weeks.

Also, the relationship between Tether USDT and Binance may lead United States government agencies to access previously undisclosed data pertaining payments in stablecoins to money laundering and terrorist organizations.

Therefore, the U.S government agencies may analyze the activities of various banks and fiat payment gateways that partnered with Binance when making various transactions which they have deemed to be illegal. This may lead the United States and other countries to take regulatory actions against stablecoin providers.

Stringent regulatory stance against Binance and other major cryptocurrency exchanges may significantly affect the performance of ETH. This is because Binance is the third largest staker of ETH, with over $1.24 billion in deposits. However, time will tell exactly how the United States regulatory agencies will treat the matter to the end.

Read more about ETH upgrades:

Conclusion

Like the other major cryptocurrencies such as Solana, ETH has been performing well since mid-October. It crossed above the $2,000 price level on 23 November. At the time of press, investors can buy ETH at a value of around $2,100. An increase in network activity and dApp performance have contributed to the current Ethereum coin upward price momentum.