In addition to basic instruments, dealers and predictors of business apparatuses rely on several indicators to determine the value of a particular instrument. Such pointers provide an easy way to identify the structures and forecast how the price will be determined.

In fact, these signals make the Forex signal possible. They support for actual-time detection of price movement, and a team of FX leaders applies them on a daily basis.

What Is Divergence?

Divergence is an important indicator that our FX leading forecasters used to support in the meaningfully rise of benefits. If used in conjunction with other indicators like moving averages (MA), RSI, stochastics, or varying sustenance and confrontation levels, it is more likely to enter the market at the exact time in the direct direction.

What Is Divergence Trading?

“Divergence trading” roots in instability or deviation. Sometimes, currency traders implemented Divergence forex trading strategies around the world.

Theoretically, costs and indicators assumed to move on the same side at equal rates. If the price is high, then the indicator is considered to be that it will reach in advance high. If the cost is low, the indicator should follow suit. The same thing put on with lower lows and highs lows.

When the cost and its related indicators are not the same, then some changes can happen. Briefly, the difference between high and low costs and indicators is a divergence calculation. The finest indicators to apply for divergence trading are stochastics, RSI, MACD, and trading volume. When a variation in the indicator is more helpful than a variation in the cost, it is called bullish divergence.

Four different kinds of divergence

-

Regular Bullish

-

Hidden Bullish

-

Regular Bearish

-

Hidden Bearish

1 – Regular bullish

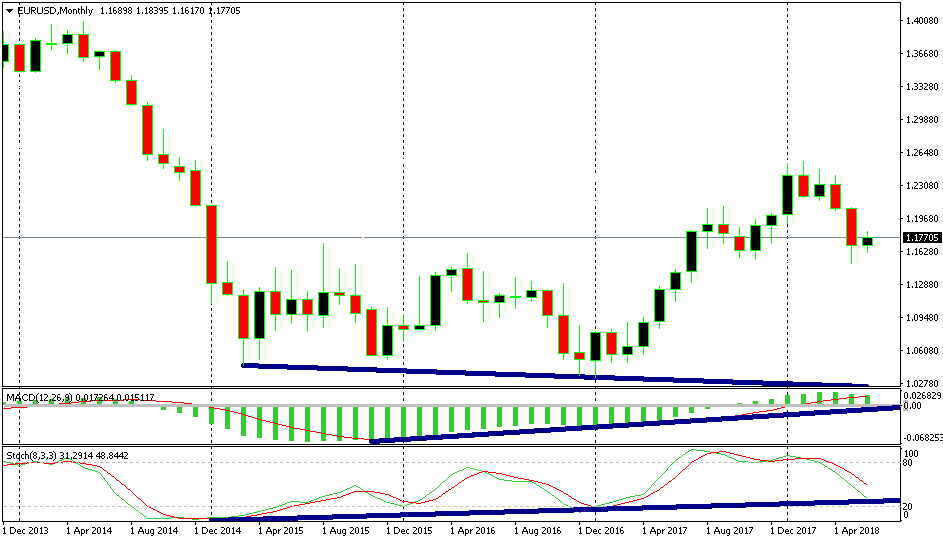

Regular divergences perform as an instrument to identify reversals. The following EUR / USD monthly chart points out the cost fluctuations over a period of two days. But the pace of MACD and stochastics is not the same as raising low point prices, which leads to ups and downs. It indicates a probable reversal of the tendency or at least a downturn review.

Moreover, the price has been trading between 1.035 and 1.0450 for nearly two years, indicates that suppliers cannot put it at any low for much longer. Longer above this level will result in a good risk/return ratio.

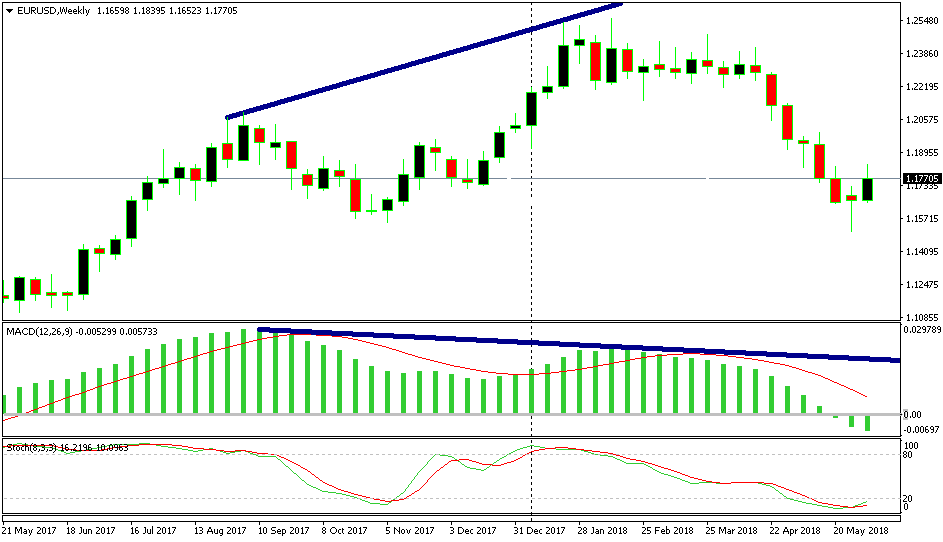

2 – Regular Bearish

From the 4 hour chart, it is clear that the price peaked last week and then peaked the next week. Conversely, the MACD indicator at the lowest of the chart is making a lower high. It is known as “Regular Bearish Divergence” and shows a reduction in the cost to appear. In such a situation, as we progress, we should suppose a reversal. After reaching the height, we should look to the exit of the trade on the up trend line.

Also Read: Carry Trade Strategy – Learn Forex Trading

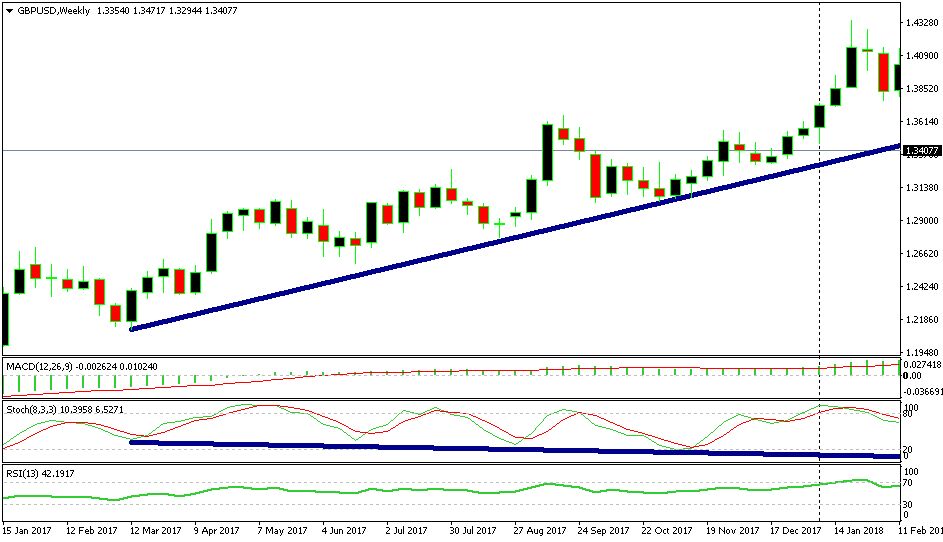

3 – Hidden blush

Opposite to regular divergence, unseen divergence shows maintenance of the trend. The following GBP / USD weekly chart indicates many instances where costs were making higher costs, while stochastic were making lower declines. Such divergence shows that the review is over, and the trend maintenance is at pause.

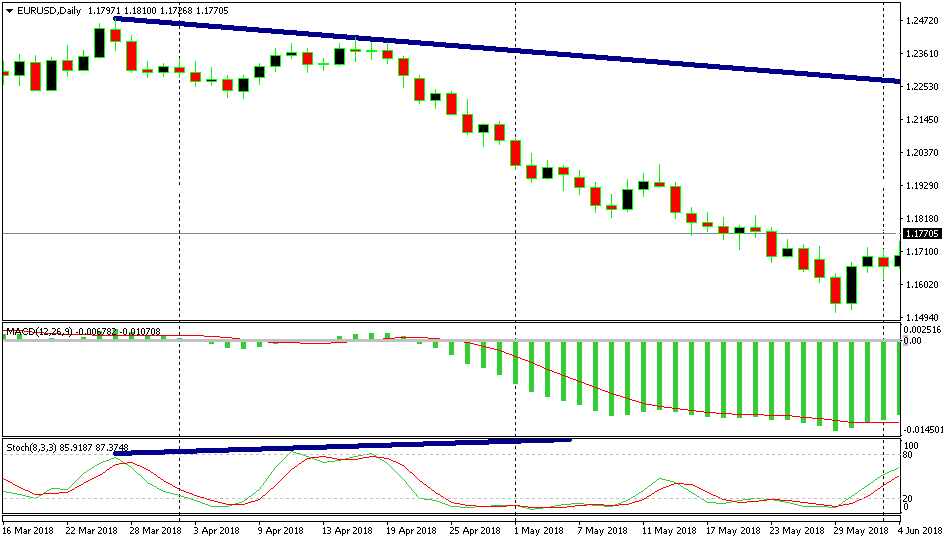

4 – Hidden Bearish

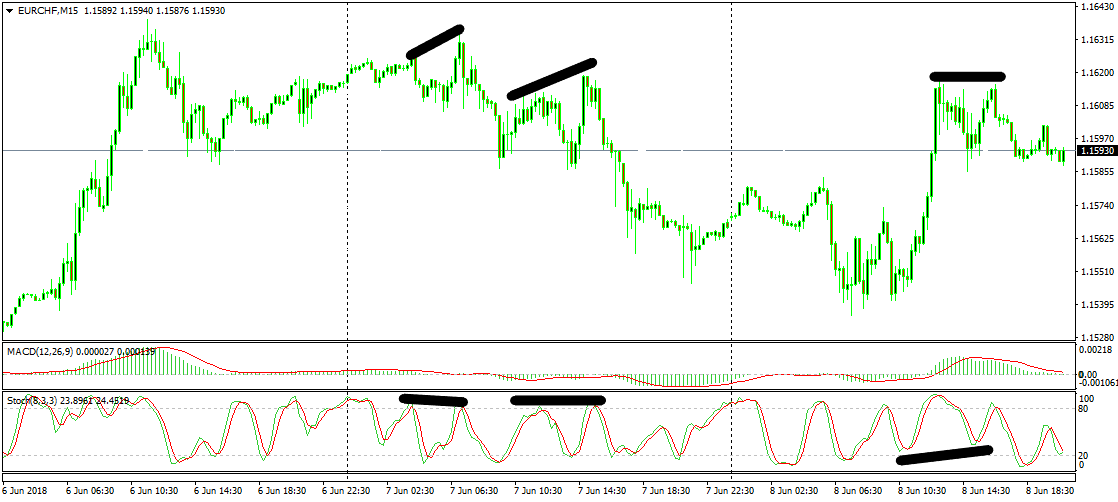

The regular EUR / USD chart below provides a strong instance of the underlying divergence and the trend setback its aftermath. It is also clear that when the stochastic was close to the overbought stage and the divergence was made following the price that made lower highs, the pair fell and starts to decline below quickly. Such a chart structure shows that when the stochastic is bought more for the second time, EUR / USD buyers cannot go further for a rise. Therefore, the reversal was comprehensive, although EUR / USD could not reach new heights. It is a reversal signal of bearish.

When to Use Divergence Forex Strategies

Deviations are easy to spot, as they need just some drawing lines. However, sometimes we take a hard look at the chart. It allows us to see things that don’t really exist. During periods of stability or low liquidity, there may be small gaps between costs and indicators. But it does not mean we should suppose them actual divergence. The following chart points out a four day stability period with the pointers and the costs that are not the same. Yet, such a procedure will not form a divergence. You must be careful that everything that is not visible in periods of stability is not really a divergence.

Divergence is one of the positive methods to use indicators to identify charts. In addition to other support and confrontation strategies, divergence forex trading can support to push your analytics skills, which is why they require to make you a real cost-effective trader.