The merger Caixabank-Bankia not only represents an important change in the physiognomy of the landscape of Spanish banking, but also has implications that go beyond the repositioning of market shares.

Both Goirigolzarri as Cortázar defend his leadership without apparent problem despite the fact that the new entity will control a quarter of the traditional services of banking and one-third of the savings in Spain. It is difficult to find a sector where the concentration is so high. And is that the domain will be more than evident in 12 of the 17 autonomous communities. Only in Madrid, it is estimated that the market share exceeds 40%, while in Catalonia, you will see even more enhanced in levels equal to or higher.

The numbers of the new reality.

The very fact that your presence will be overwhelming in the two richest regions of Spain, generates an additional analysis of the fees or deposit credit for the fact that there are other areas where the concentration assumes an even greater impact.

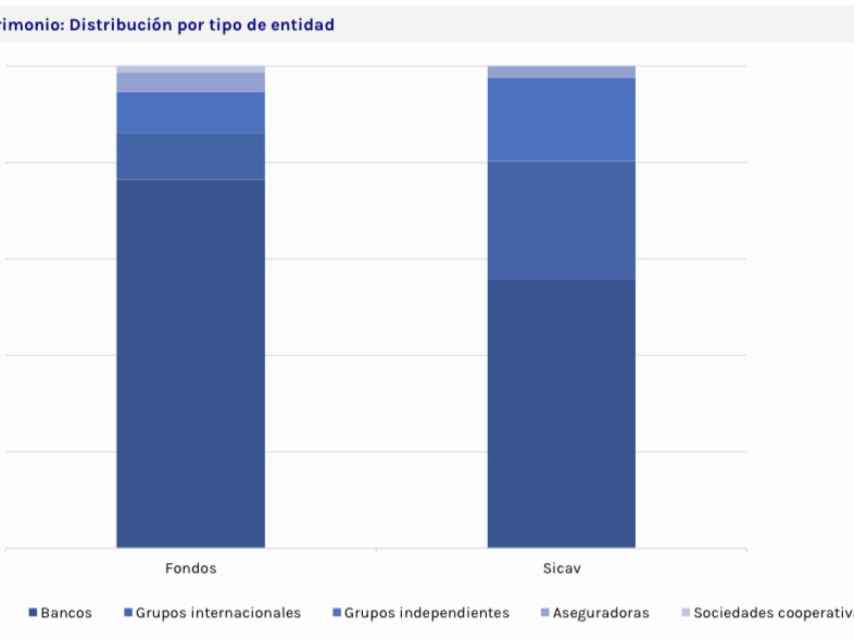

The fund industry, Spanish is a sector domain the majority of financial institutions as is demonstrated in that the banks control 76.5% of the investment funds, 82.5% of the pension plans and 55.7% of the Sicav. According to data from Inverco, and without having the business of IIC foreign, the merger will mean that one out of every four mutual funds and one out of every three pension plans, will be the domain of the new management resulting.

And is that increasingly the management of the saving is on its way to a concentration overwhelming. Only the three major national entities, the new CaixaBank, Santander and BBVA, which control more than half of the market of investment funds. With data from the first half of 2020, in Spain there are 48 funds whose wealth exceeds 1,000 million euros.

Well, CaixaBank leads the standings with 14 funds in addition to the five of Bankia. That supposed to strengthen its leadership with 40% of the largest national funds. Only an entity that is not a bank, Mutuactivos, has a background in that relationship. And the icing on the cake is in the catchments. It is hard to find in the relationship of monthly net subscriptions an entity that is not a bank leading this ranking. The advantage of the brand, the network and the commercial power, are a noose that tightens, and sometimes stifles, to the independent management.

Precisely, the impact of the transaction on the independent management can be devastating. The management small is not linked to banking groups, with a lightweight structure and capabilities very limited, they will be thrown into a process of integration in order to avoid its disappearance. Denying this reality will only certify a death that will be slow and agonizing.

If a small organisation with a heritage that is lower than the 500 million euros already, it was difficult to compete with the huge distribution capability of a bank, this operation question even more their survival. The commercial resources of a bank are overwhelming (advertising, trade incentives, network of agents, branches…).

This forces small entities to generate better results to be able to wield the argument of the return as a flag of its own.

This forces small entities to generate better results to be able to wield the argument of the return as a flag of its own. And here is where they collide with the harsh reality. The bags are out of cycle, the fixed income takes forty years to rise and today offers returns are negative or close to zero and the monetary funds cost money to the participant.

How are they going to generate that extra return? Or squeezing the talent for the search of ideas or in assuming greater risk. And that is what is happening in the industry. On the one hand, the managers-iconic value investing they have embarked on a difficult and complicated quest to find profitability while the rest have opted for the easy road is to invest in technology, that is to say, to buy momentum.

The effort of survival in the industry of the management of IIC is doubled since the entities will have to consider a deep renewal in a time when the margins move to the downside. In recent years it has been trying with the emergence of funds, illiquid and alternative, but that is a niche market in which the banks have also been launched to compete with the same resources that give advantage with traditional funds.

Unlike a credit or a deposit, where the competition is measured in very few basic points, and which shall be under the exclusive domain of not more than five or six banks, the management industry has room to redefine itself and look for your site. But that’s going for a radical change in the physiognomy of the Spanish market. Until that small entities do not make a real exercise of reflection, the oligopoly that currently have the banks on the management and the savings will continue crushing the dreamers who believe they alone will be able to cope with this new reality.

*** Alberto Roldán is an economist and manager.