Stablecoins have been the lifeblood of crypto trading in recent years. Most traders prefer using the digital dollar or euro representations to depositing fiat currency. Arbitrum welcomed a healthy influx of stablecoins last week, and USDC remains the dominant pegged currency on the network.

One can argue that increasing on-chain stablecoin balances isn’t necessarily a big deal. However, it shows the viability of alternative networks for pegged currencies. There is more to this ecosystem than Ethereum, Tron, or BNB Chain for stablecoin activity. Therefore, other networks should not be overlooked, even if their “pegged asset market cap” isn’t that high.

It is unlikely any network will compete with Ethereum for the top stablecoin network position. Ethereum holds over $80 billion in various assets pegged to the US Dollar and Euro. It is the most liquid network and will retain that position for the foreseeable future. Tron puts up a good fight with its $37.2 billion in pegged currencies, but there is still a massive gap to overcome.

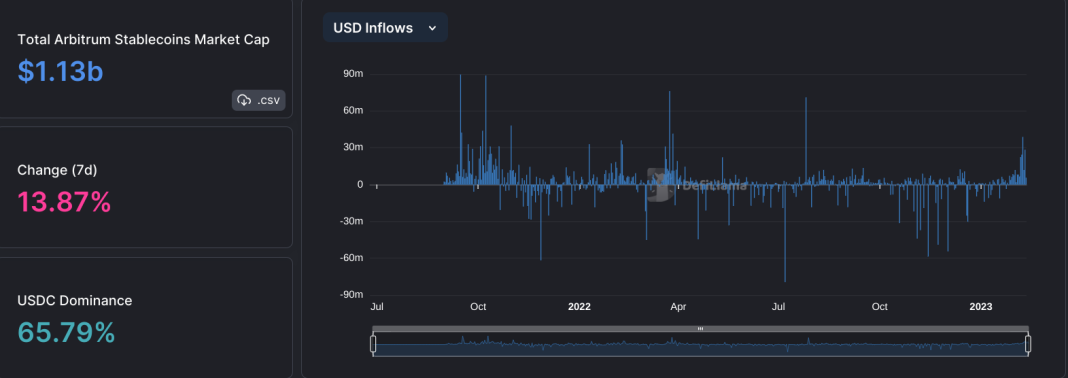

Interestingly, there are now seven networks with over $1 billion in stablecoins in network circulation. Arbitrum has joined BNB Chain, Polygon, Solana, and Avalanche. The Layer-2 solution continues to progress in cryptocurrency and decentralized finance. That said, the network sits at $1.13 billion in stablecoin market cap, and may overtake Avalanche, Solana, and Polygon if it continues its growth curve.

A weekly increase by nearly 14% in stablecoins paints an intriguing picture. Like other networks, USDC is the dominant currency on the network, as USDT continues to fall out of favor. USDC Is the top stablecoin on Ethereum, Polygon, Solana, Avalanche, Arbitrum, Optimism, Fantom, and Canto. That latter network has also seen a 9% gain in stablecoin market cap in the past week.

The top pegged currencies on Arbitrum are USDC, USDT, and DAI. It is remarkable to see so many multi-chain stablecoins on the market today. However, the Layer-2 network has native stablecoins like Vesta Stable ($8.5m market cap), DigitalDollar ($2.57m market cap), and Sperax USD ($1.86m market cap). It will be interesting to see if these native currencies can note long-term success.

While Arbitrum and Canto note a good influx of stablecoins, Terra Classic looks very different. That isn’t surprising, as the “Terra” name still leaves a bad taste in people’s mouths. That doesn’t mean Terra Classic can’t succeed in the long run. However, it is a tainted project and primarily serves the USTC stablecoin. There doesn’t appear to be sufficient demand for that asset in the current market.

The post Arbitrum Has Higher Stablecoin Growth Than Other Networks appeared first on CryptoMode.