Cryptocurrency mining has gained significant popularity in recent years. As a result, people have been investing in mining equipment and software to mine cryptocurrencies like Bitcoin, Ethereum, etc. But the question remains: is cryptocurrency mining worth it? This article explores the realities of cryptocurrency mining and helps you understand if it’s a profitable venture.

Understanding Cryptocurrency Mining

Before we delve into the profitability of cryptocurrency mining, let’s first understand what it is. Cryptocurrency mining is verifying transactions on a blockchain network using specialized computer hardware. Miners are rewarded with cryptocurrency tokens for solving complex mathematical problems that secure the network.

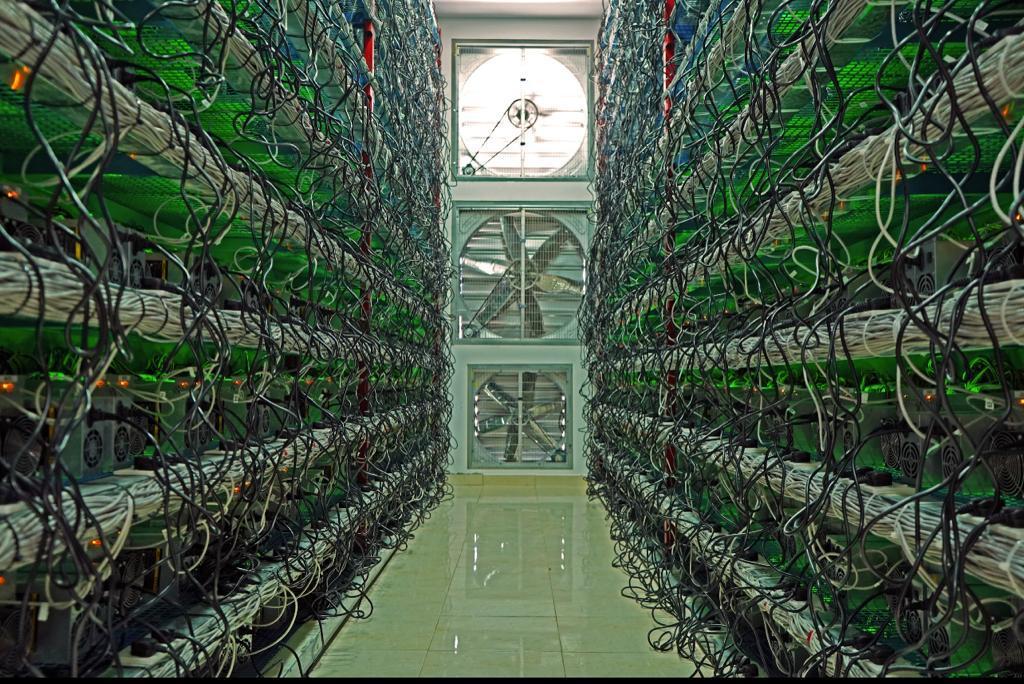

The process of mining requires a significant amount of computational power, electricity, and cooling to prevent equipment from overheating. Mining can be done through two methods: solo mining or pool mining. Solo mining involves mining alone, while pool mining involves joining a group of miners to increase your chances of earning rewards.

The Cost of Cryptocurrency Mining

The profitability of cryptocurrency mining depends on the cost of electricity, hardware, and other associated expenses. As the complexity of mining increases, so does the cost of equipment and electricity.

Additionally, the rewards for mining decrease as more miners join the network, making it challenging to earn a significant amount of cryptocurrency tokens.

In many cases, the electricity cost can be miners’ largest expense. This is particularly true in areas with high electricity fees. In addition, mining hardware also requires regular maintenance and upgrades, adding to the overall cost.

Calculating Profitability

To determine if cryptocurrency mining is worth it, you must calculate profitability. That involves estimating the cost of equipment and electricity, as well as the potential rewards for mining. Several online calculators can help you estimate the profitability of mining for various cryptocurrencies.

However, remember that these calculators only provide estimates and not exact figures. Furthermore, the profitability of mining can fluctuate depending on several factors, including the cryptocurrency’s price, the number of miners, and the mining difficulty.

The Risks of Cryptocurrency Mining

Like any investment, cryptocurrency mining comes with its own set of risks. The price of cryptocurrencies can be volatile, and the mining rewards can change quickly. Additionally, mining hardware can become obsolete quickly, reducing its resale value.

There is also the risk of equipment failure, resulting in lost profits and increased costs for repairs or replacements. Finally, there is the risk of hacking and cyber attacks, leading to losing mined tokens and other personal information.

Conclusion

In conclusion, cryptocurrency mining can be a profitable venture if done correctly. However, the equipment and electricity costs and the mining risks must be carefully considered before investing.

Calculating the potential profitability and understanding the risks involved before investing in mining equipment is essential.

If you’re interested in cryptocurrency mining, it’s essential to research and stay up-to-date with the latest trends and developments. By staying informed, you can make informed decisions and minimize your risks.

The post The Realities of Cryptocurrency Mining: Is it Worth It? appeared first on CryptoMode.