The year 2022 wasn’t the best for the crypto markets. Many assets lost over 60% of their value, and the mainstream perception regressed slightly. Even so, numerous projects secured funding in early 2023, as bear markets are an excellent time to build.

Securing funding for a crypto project or startup is never easy. Although one can have excellent ideas, convincing investors is tricky. Only some people see merit in blockchain technology and cryptocurrency and expecting them to have a bright future. In addition, there is a growing liquidity crunch in the broader technology sector, leaving less money on the table for new ventures.

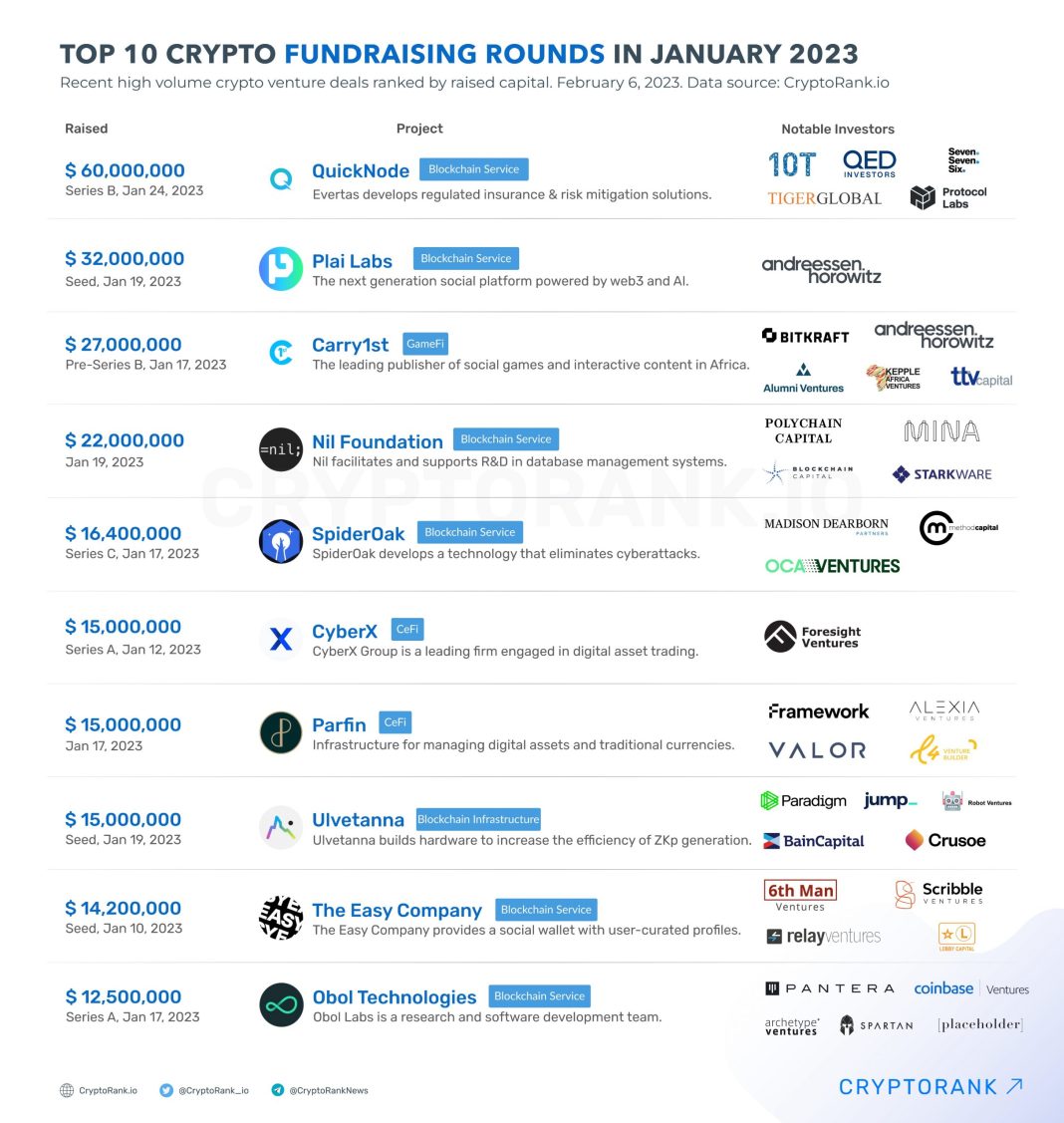

Thankfully, there have been fundraising rounds worth over $12 million in January. That is significant, as it confirms there is still strong interest in the cryptocurrency space. That doesn’t mean all of the projects in the screenshot below will succeed, though. However, it does confirm there is a varied approach to providing blockchain services, GameFi, CeFi, and infrastructure.

QuickNode, one of the many aspiring blockchain services providers, secured $60 million in Series B funding last month. That is a significant amount for a blockchain development platform. However, QuickNode wants to make building and scaling web3 applications more mainstream. There is a growing interest in building Web3 solutions, and Protocol Labs, 10T, QED Investors, and others consider this platform a strong contender for the future.

Speaking of Web3, Plai Labs is another blockchain service in the same vertical. It aims to become a next-generation social platform powered by AI, and secured $32 million from Andreessen Horowitz. That same investor also contributed to the $27 million Pre-Series B funding for Carry1st, a publisher of social games and interactive content in Africa.

Other projects raising capital tackle various industry verticals, including:

- R&D in database management

- Eliminating cyberattacks

- Digital asset trading and management

- Building ZKP-oriented hardware solutions

- Social wallet features

- Research and software development

It is also good to see so many different notable investors. Prominent names like Polychain Capital, Starkware, Jump, Pantera, and Coinbase Ventures are all represented. However, some lesser-known names are Valor, Alexia Ventures, Crusoe, 6th man Ventures, and TTV Capital.

Overall, there is a healthy interest in crypto and blockchain. Although inflation remains a problem and many fundraising efforts won’t reach their goal, there are ample success stories to note. It is now up to these teams to deliver on expectations without making compromises. That is always tricky when VCs and big investors are concerned, as seen in the recent Uniswap debacle.

The post 10 Crypto Firms Each Secured Over $12.5M In Investments Last Month appeared first on CryptoMode.